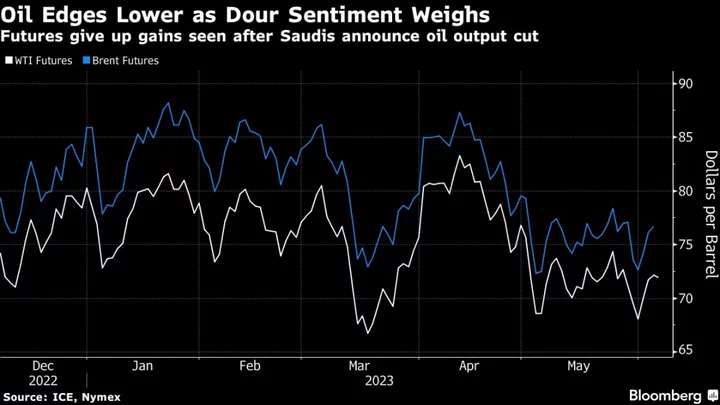

Oil edged lower as traders weighed the outlook for supply and demand after Saudi Arabia’s surprise pledge for extra supply cuts.

West Texas Intermediate dipped below $72 a barrel on Tuesday as a cautious tone spread across markets. Futures surged early Monday following the Saudi announcement after a tense OPEC+ meeting, before giving up most of the gains during the session. The kingdom also raised its crude prices to Asia for July.

Saudi Arabia pledged to do “whatever is necessary” to stabilize the market as concerns over the demand outlook, especially from China, weighed on prices. Oil tumbled 11% last month, in part due to resilient Russian output, despite the OPEC+ producer saying earlier this year it would reduce supply.

The kingdom followed its move to cut output by 1 million barrels a day in July with an increase to its crude prices for the same month. It was expected to trim the cost of its oil, according to a survey of buyers in Asia, which was carried out prior to the OPEC+ meeting.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.