Global investors have little confidence that China will succeed in shoring up its financial markets, predicting that mounting economic stress will drive the yuan’s offshore exchange rate to historic lows.

The yuan traded internationally is seen depreciating to 7.6 per dollar before the end of the year, according to the median estimate by 455 respondents in the latest Markets Live Pulse survey. That implies a drop of 4% from the current level of 7.29 and would be a record low for the currency.

Underlining the country’s bearish outlook, just 19% of survey participants plan to increase their China exposure over the next 12 months, while 24% plan to reduce their holdings. That’s a shift from March, when 25% of investors said they would boost exposure.

Beijing intensified efforts to halt a rout in the nation’s assets in recent days. Authorities urged financial institutions to buy stocks and the yuan, made it more expensive to short the offshore yuan through higher funding costs, and told mutual funds to stop selling equities.

While these efforts briefly lifted markets, foreign funds have continued to sell at a record pace amid concern over China’s struggles with falling prices, a slumping property market and soaring local government debt. Wall Street analysts are also turning more downbeat, with Morgan Stanley and Goldman Sachs Group Inc. lowering their targets on Chinese stocks in the past week.

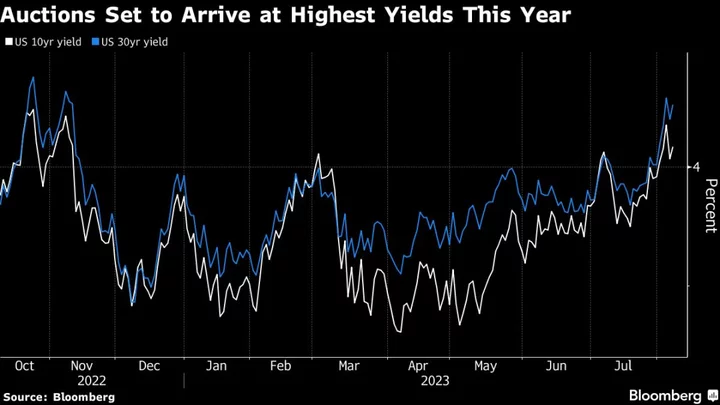

China’s easier monetary policy at a time when the rest of the world is tightening is adding pressure on the yuan, as investors turn to higher-yielding US assets. Two-year US Treasuries yield almost 3 percentage points more than the Chinese equivalent, the biggest premium since 2006.

The central bank’s “policy response to support the yuan hasn’t been effective in changing the trend and won’t be,” said Kiyong Seong, a strategist at Societe Generale SA in Hong Kong.

Unlike in 2008, when China unleashed massive spending programs to bolster growth, few expect the country to launch large-scale measures this time round to save the economy. Only 11% of MLIV Pulse respondents expect policymakers to unveil “bazooka-like” stimulus, with the majority predicting moderate measures targeting specific industries. Another 32% said any policy rescue will be too little, too late.

While authorities have issued plenty of rhetoric in support of the economy, specific action has been limited. During his presidency, Xi Jinping has sought to end the reckless debt-fueled expansion that typified the years in the wake of the 2008 stimulus blitz and fueled heady economic growth.

Read more: Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail

“Things are coming,” said David Loevinger, a managing director at TCW Group Inc, about the stimulus. “But it seems like there’s an internal debate about what you need to do in the short term without losing sight of your long-term policy objectives.”

While US President Joe Biden labeled China’s economic woes a “ticking time bomb” for the world and Treasury Secretary Janet Yellen called them a “risk factor” for the US, investors see limited spillover risk right now.

About 31% of MLIV Pulse respondents said the MSCI China Index would need to drop another 20% in the next month to trigger a global rout, while another 33% said Chinese equity losses won’t lead to any significant contagion.

Similarly, a majority of market participants — 56% of respondents — said China’s slowdown won’t have a significant impact on actions by other key central banks such as the Federal Reserve.

Because major economies have limited export and banking exposure to China, “a debt-induced economic downturn in China likely would not trigger another global financial crisis à la 2008,” Wells Fargo & Co. economists including Jay Bryson wrote in a note.

The MLIV Pulse survey of Bloomberg News readers on the terminal and online is conducted weekly by Bloomberg’s Markets Live team, which also runs the MLIV blog. This week, the survey asks whether a 4.5% 10-year Treasury yield would sink the stock market. Share your views here.