The world’s advanced economies are heading into a deepening slowdown as markedly higher interest rates take a hefty toll on activity that could still become more acute, the OECD warned.

Growth is losing momentum in many countries and won’t edge up until 2025, when real incomes recover from the inflation shock and central banks will have begun cutting borrowing costs, the Paris-based organization said.

It forecasts global gross domestic product to expand only 2.7% next year after an already weak 2.9% in 2023. The pace will only pick up to 3% in 2025, according to the assessment.

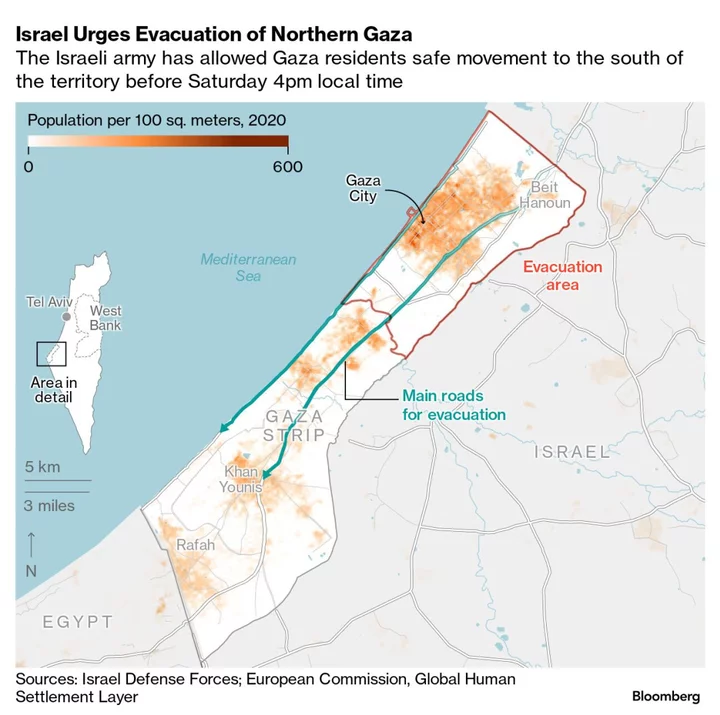

Moreover, the OECD said the risks to the forecast are tilted downwards amid heightened geopolitical tensions, an uncertain outlook for trade, and the risk that tight monetary policy could hurt firms, consumer spending and employment more than expected.

“Inflation is easing, but growth is slowing,” OECD Chief Economist Clare Lombardelli said in a statement. “We are projecting a soft landing for advanced economies, but this is far from guaranteed.”

The gloomy perspective points to a long hangover from the global inflation crisis that followed the Covid pandemic and a surge in energy prices after Russia’s invasion of Ukraine.

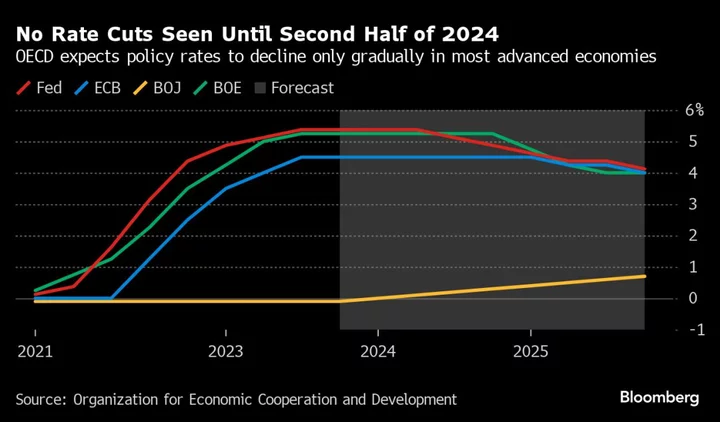

Central banks reacted to that with some of the sharpest and fastest rate increases in history, and have indicated they may stay at high plateaus for some time.

The OECD said that even as headline measures of inflation have declined, gauges of core prices are proving sticky — and monetary policy must remain restrictive until there are clear signs underlying pressures are durably lower.

It expects rate cuts in the US will only begin in the second half of 2024, and not until the spring of 2025 in the euro area. That contrasts starkly with the expectations of markets, which are currently pricing the Federal Reserve and the European Central Bank will ease policy as soon as the first half of next year.

The OECD observed that emerging markets are generally faring better than advanced economies. Among the latter, Europe is lagging the US, in part because countries there are more sensitive to interest rates as they rely more on bank-based finance, the organization said.

A “challenging fiscal outlook” is confronting many governments as debt-servicing costs rise, the OECD warned. To meet demands from aging populations and the climate transition, it said countries need to make stronger efforts in the near term to create space for future spending.

“In summary, the global economy is grappling with inflation, slowing growth, and mounting fiscal pressures,” Lombardelli said.