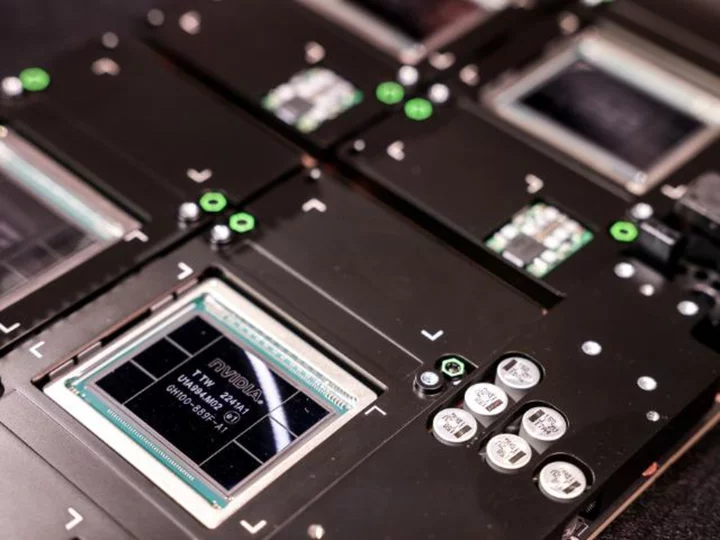

The artificial intelligence boom continues to fuel a blockbuster year for chipmaker Nvidia.

Nvidia's stock jumped as much as 9% in after-hours trading Wednesday after the Santa Clara, California-based company posted year-over-year sales growth of 101%, to $13.5 billion for the three months ended in July — a new record for the company.

The results were even stronger than the $11.2 billion in revenue that Wall Street analysts expected. The company's non-GAAP adjusted profits grew a stunning 429% from the same period in the prior year to $2.70 per share, also beating analysts' expectations. GAAP stands for generally accepted accounting principles.

Nvidia expects revenue to be even higher in the current quarter: forecasting revenue of $16 billion for its fiscal third quarter.

"Demand for our data center platform for AI is tremendous and broad-based across industries and customers." Nvidia's chief financial officer Colette Kress said on the company's earnings conference call about the forecast.

Nvidia's stock has climbed by just over 220% since the start of this year amid a surge in the popularity of and demand for artificial intelligence technology. The American chipmaker produces processors that power generative AI, technology that can create text, images and other media — and which forms the foundation of buzzy new services such as ChatGPT.

"A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI," Nvidia CEO Jensen Huang said in a statement, adding that the company is working with "Leading enterprise IT system and software providers ... to bring NVIDIA AI to every industry."

"The race is on to adopt generative AI," he said.

Huang had said following the company's May earnings report that the firm was ramping up its supply to meet "surging demand."

"Nvidia's hardware has become indispensable to the AI-driven economy," Insider Intelligence senior analyst Jacob Bourne said in emailed commentary. "The pressing question is whether Nvidia can consistently exceed the now-higher expectations."

The chipmaker's gaming division, once its main business, grew to $2.5 billion — an 11% increase from the previous quarter and a 22% jump year-over-year.

"We believe global demand has returned to growth after last year's slowdown," Kress said of Nvidia's gaming unit.

However, not all of Nvidia's businesses grew. Second-quarter revenue for the chipmaker's professional visualization unit, which makes high-end graphics, was $379 million, down 24% from one year ago.