A handful of retailers and tech companies reporting this week, truncated by the Thanksgiving holiday, will show firms grappling with weaker consumer and corporate spending.

Best Buy Co., Nordstrom Inc. and Lowe’s Cos. are set to post slumping sales, reflecting the consumer pullback in discretionary sales that’s already been flagged by retail peers Walmart Inc. and Target Corp. The growing reluctance among households to make big-ticket purchases, however, could benefit the likes of Miniso Group Holding Ltd., which targets consumers with small gifts and snacks.

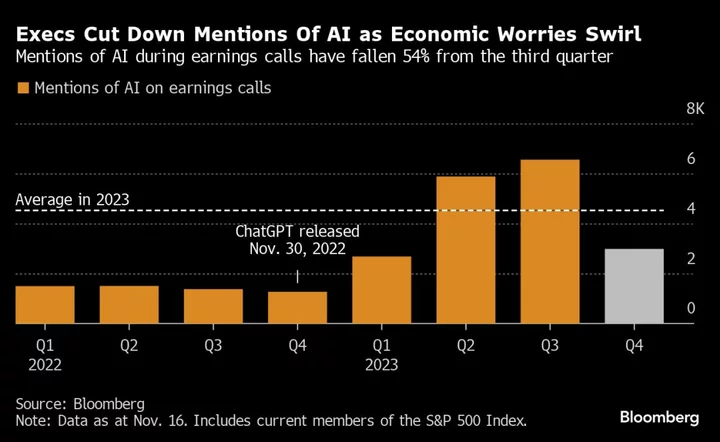

Nvidia Corp.’s quarterly results could still exceed sky-high investor expectations thanks to strong demand for generative artificial intelligence. AI buzz notwithstanding, HP Inc. and Zoom Video Communications Inc. earnings will be muted by constrained corporate budgets.

Monday: Trip.com’s (TCOM US) quarterly adjusted earnings per share more than tripled, borne by strong domestic summer travel demand in China. The Shanghai-based online travel agency’s strategy of bundling tourist-attraction and music-festival tickets with accommodations will help it navigate sagging demand for outbound travel, Bloomberg Intelligence said.

- Zoom (ZM US) will eke out adjusted earnings per share growth of 2.4%, reflecting the mature state of the virtual meetings market. Tighter corporate IT expenditures will mean tepid growth in Zoom’s enterprise segment, BI said, adding that the company’s new products will require time to have a significant impact on earnings.

Tuesday: Nvidia (NVDA US) quarterly sales could exceed consensus forecasts with a 170% surge amid sustained generative AI demand for accelerators, BI said. The firm’s ability to quickly produce chips for China that also comply with export controls imposed by US regulators should help mute the impact of these restrictions on its earnings, BI added. Investors will pay particular attention to how the US curbs on AI chip exports to China will affect Nvidia’s data center business, Citi said.

- HP (HPQ US) sales likely shrank 6.3% in the quarter, improving from the double-digit contractions of the last four quarters. Cost-cuts and better demand in the computer market should be supportive of earnings in the months ahead, Citi said.

- Best Buy (BBY US) sales likely shrank for the eighth straight quarter though a better-than-expected back-to-school season — in particular a pickup in demand for computing and mobile phones — helped narrow the decline to about 6.5% from 7.2% in the preceding period. The performance of Best Buy’s early Black Friday promotions will give an indication of holiday demand, BI said.

- Nordstrom’s (JWN US) revenue is seen dipping 2.1% in what would be a fifth consecutive quarter of falling sales. Foot-traffic data suggests fewer shoppers at both its main and Nordstrom Rack stores, Citi noted. Investors will focus on management guidance for the holiday season and the 2024 outlook along with comments from new Chief Merchandising Officer Jamie Nordstrom, BI said.

- Burlington Stores (BURL US) may miss consensus estimates of 13% quarterly sales growth, BI said. The retailer’s business is sensitive to temperature conditions, and warmer-than-expected weather during the period may have cooled sales, Citi said. Efforts to offer more recognizable brands in stores could draw more shoppers in the coming months as they trade down, BI said.

- Same store sales were at their worst in five quarters for Dick’s Sporting Goods (DKS US) though the retailer’s focus on its own DSG brand and in-store theft reduction likely nudged gross margin higher to 35% from 34% in the previous quarter, BI said.

- Observed sales for Kohl’s (KSS US) fell 9.2% in the third quarter compared with a 10% median decline for department stores during the same period. Higher gas prices, elevated interest rates and rising credit card delinquencies continue to pressure discretionary spending, though efforts to reduce selling, general and administrative expenses will start to pay off in the next quarter, Cowen said.

- Miniso (MNSO US) is set to chalk up a 35% rise in revenue, its third consecutive quarter of double-digit expansion, as it grows its global store footprint. Average sales per store in its domestic Chinese market is seen at about 85% of its 2019 level as the retailer continues to recover from the lifting of pandemic curbs in the country, Jefferies said. Miniso’s ability to maintain the current momentum of its store openings in the face of macroeconomic uncertainty will be scrutinized.

- Lowe’s (LOW US) same-store sales are set to fall 4.9%. The home improvement store’s exposure to do-it-yourself customers could prove a “particular challenge” though sales to its professional-contractor segment are also moderating, BI said.

- Baidu’s (BIDU US) quarterly results are likely to be “lackluster” as a slowdown in the Chinese economy erodes advertising revenue, BI said. The internet search engine’s AI chatbot has yet to make a material contribution to earnings, while rising costs related to its AI business could start to eat into margins. Revenue is seen 5.1% higher, about a third of the preceding quarter’s gain.

- Medtronic’s (MDT US) revenue could have grown 4.4% and easy year-over-year comparisons should allow it to beat expectations for a fourth consecutive quarter, BI said. The medical device-maker’s product pipeline will be in focus, with investors especially keen on an updated timeline for its renal denervation system, which a US Food and Drug Administration panel of independent experts failed to recommend.

Wednesday: Deere (DE US) could be conservative with its guidance for 2024 when it reports pre-market, BI said. With the farm-equipment market showing signs of slowing, the firm could give net income guidance below analysts’ consensus forecast of $9.3 billion. BI, however, expects any downturn to be more moderate then previous cycles.

Thursday: No notable earnings. Markets closed for Thanksgiving holiday.

Friday: No notable earnings.

Author: Gabriel Sanchez, Redd Brown, Rachel Phua and Ignacio Gonzalez