Nigeria will spend at least six times more on servicing its debt next year than on building new schools or hospitals in the West African nation, where more than 40% of the population live in extreme poverty.

President Bola Tinubu on Wednesday outlined 2024 spending plans projected at 27.5 trillion naira ($34.7 billion), of which 30% will go to pay borrowing costs. Spending on education will consume 7.9% of the budget while healthcare gets 5% and infrastructure a similar amount.

“The proposed budget seeks to achieve job-rich economic growth, macro-economic stability, a better investment environment, enhanced human capital development, as well as poverty reduction and greater access to social security,” Tinubu told lawmakes in the capital Abuja. It was his first budget presentation since taking office in May.

Direct allocations to social development and poverty reduction will only get 4% of the budget. In the six months through June, the nation spent a lofty $3.85 billion servicing debt. That compares with $8.1 billion in 2022.

High debt-service costs complicate Tinubu’s goal to double the size of Africa’s largest economy to $1 trillion by 2030 and lift 100 million of its people out of poverty.

Boost Revenues

To tackle this, the government set an ambitious revenue target of 18.3 trillion naira for 2024, which if achieved will result in debt-service costs consuming 45% of projected revenue, compared with 98% this year, and a narrower budget deficit.

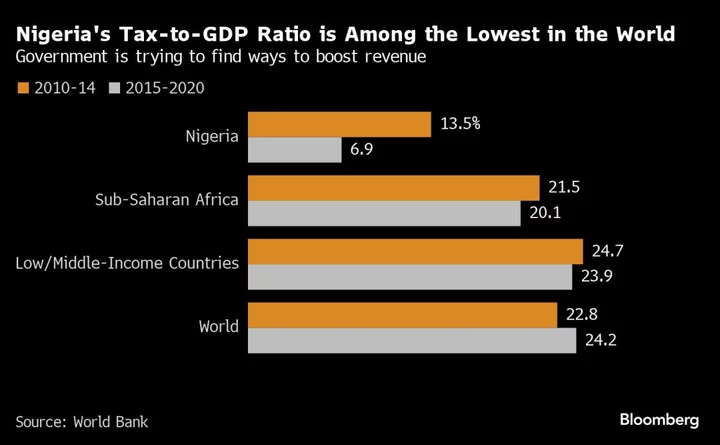

“Our target is to increase the ratio of revenue to GDP from less than 10% currently to 18% within the term of this administration,” Tinubu said. “Government will make efforts to further contain financial leakages through effective implementation of key public financial management reforms.”

In the past, revenue has fallen short of forecast and forced the government to rely significantly on borrowing to meet its public spending needs. However, revenue collection looks to have improved as the government raised revenue of 8.65 trillion naira in the nine months through September, which was above the target for the period, Atiku Bagudu, minister for budget and national planning said Wednesday.

The World Bank estimates Nigeria’s 2021 revenue ratio was among the five lowest globally at about 7% of gross domestic product.

The 9.18 trillion naira budget-deficit forecast for next year will be funded mainly from new borrowing, proceeds from privation of government assets and lending from multilateral lenders including the World Bank and the African Development Bank.

“Government assets for which we are not generating revenue ‘might be best’ transferred to private hands,” Bagudu said.

The AfDB pledged a $1 billion loan for budget support as a “reward for ongoing macro-economic reforms,” Finance Minister Wale Edun said on Monday. The government also expects to receive $1.5 billion from the World Bank.

While the 2024 budget is based on an exchange rate of 750 naira per dollar, the government expect that reforms in the forex sector will see the naira strengthen from 2025, Bagudu said. The government targeting economic growth of 3.8% next year.

Africa’s largest crude producer projects that oil prices will average $77.96 per barrel and is targeting output at about 1.78 million barrels per day. That compares with an average of 1.35 million barrels per day in October and 1.57 million barrels a day in the past three years, according to the nation’s budget office.

Nigeria has been unable to meet its OPEC+ allocation this year, and the alliance of oil producers is considering cutting its quota next year from 1.74 million barrels a day currently.

Author: Anthony Osae-Brown, Ruth Olurounbi and Nduka Orjinmo