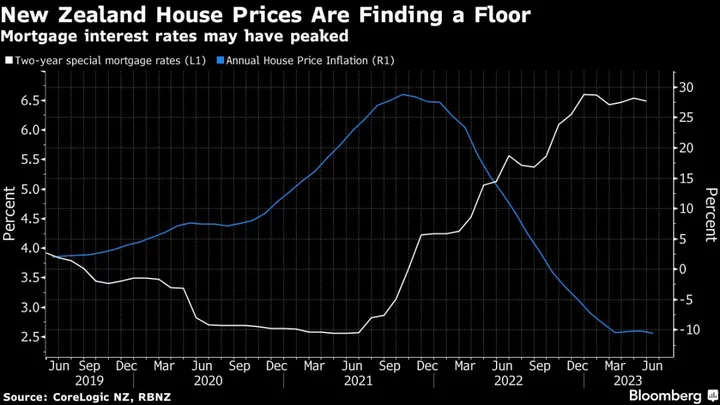

Economists have called an end to New Zealand’s housing slump, saying latest data show the market has found a floor and prices are starting to recover.

A Real Estate Institute of New Zealand report released Thursday in Wellington shows house prices rose 0.4% in June while sales continued to recover. Economists at ANZ Bank, Westpac and Kiwibank all said the report is the latest sign that housing demand is starting to outstrip supply amid record immigration.

“The turning point in the house price cycle has arrived,” said Miles Workman, senior economist at ANZ Bank New Zealand in Wellington.

Satish Ranchhod, senior economist at Westpac in Auckland, concurred. “The latest update from REINZ reinforced the sense that New Zealand’s housing market has found a base, with both sales and prices pushing higher,” he said.

New Zealand house prices have dropped almost 18% from their peak in November 2021 as the central bank hiked interest rates aggressively to tame inflation. While mortgage rates aren’t expected to drop any time soon, they aren’t seen rising any further after the Reserve Bank yesterday reinforced the view that its tightening cycle has ended.

Kiwibank chief economist Jarrod Kerr said it appears that most, if not all, of the housing market correction has now played out.

“The peak in interest rates will mark the bottom of the downturn,” he said, adding that surging migration and the prospect of rate cuts on the horizon should fuel a housing rebound.

“We see a return to monthly house price gains — albeit very modest gains — beginning from the second half of the year,” Kerr said.

ANZ expects prices will lift about 3% in the second half.

The REINZ report showed house prices fell 9% in the year through June, but the median price has recovered to NZ$780,000 ($491,000) from a low of NZ$762,000 in February.