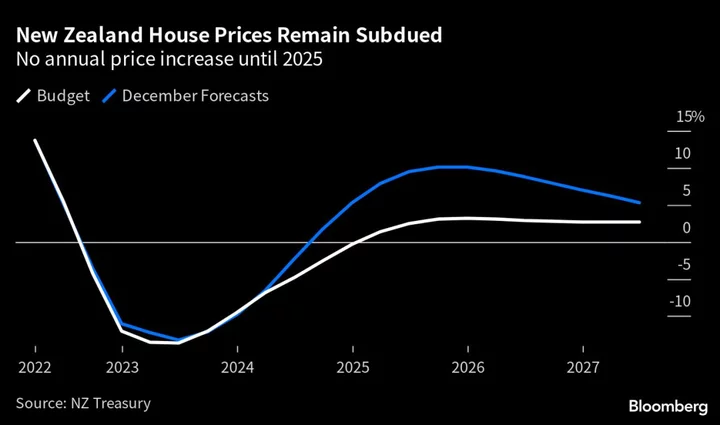

New Zealand house prices will extend their declines into 2024 in the face of a softer labor market and high borrowing costs, according to Treasury Department projections.

The housing downturn, which began at the start of 2022, will extent to 10 straight quarters, with the first lift in values coming in the third quarter of 2024, according to forecasts in Thursday’s budget. That’s a more prolonged fall than the Treasury expected in December, when price gains were tipped to resume in the first quarter of 2024.

The revised outlook means house prices are now expected to be little changed in 2024 rather than rising 5% as projected in December.

“The Treasury expects higher-for-longer interest rates to continue driving house prices lower,” the agency said in the budget. Prices have fallen 15% from the late 2021 peak and have more than 6% further to drop, it said.

The Reserve Bank is tipped to raise the Official Cash Rate to 5.5% next week, and some economists expect one or even two further hikes may be needed to curb inflation. Rising unemployment and slower wage growth may also weigh on housing demand, even as surging immigration potentially brings more buyers into the market.

“While net migration will add to demand for housing, this is expected to have a limited impact on residential construction given the already significant increase in housing supply over the past two years,” the Treasury said.

The Treasury is also less optimistic about the eventual pace of a house-price recovery. It expects prices to rise 3.2% in 2025 rather than the 10% it projected in December.