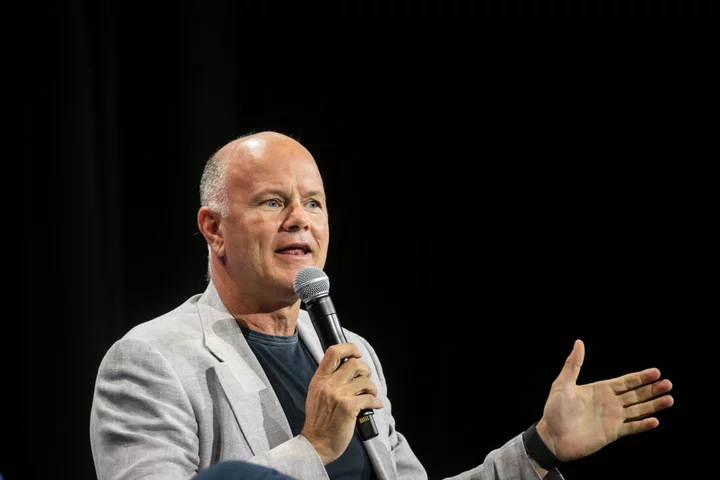

Regulators are the first line of defense to ensure companies such as Coinbase Global Inc. abide by securities-trading rules, Nasdaq Inc. Chief Executive Officer Adena Friedman said.

Nasdaq works with the US Securities and Exchange Commission and the Financial Industry Regulatory Authority to aid their enforcement efforts, Friedman said at the Bloomberg Invest conference Wednesday.

The SEC on Tuesday sued Coinbase, a Nasdaq-listed company, alleging the firm runs an illegal exchange. A lawyer for the firm has said Coinbase has a “demonstrated commitment to compliance.” Earlier this week, the SEC also sued Binance Holdings Ltd. over a number of purported violations.

“That’s really a job for the SEC,” Friedman said.

Friedman said that before a company goes public on the New York-based exchange, the SEC and Nasdaq evaluate it, and take a keen look at its risk factors among other items. In this “particular case,” Friedman said, there may have been some changes in the company’s risk factors.

--With assistance from David Westin.