A likely re-weighting of Sirius XM Holdings Inc. in the Nasdaq 100 is adding another twist to the stock’s wild moves, with the market transfixed by an unprecedented short squeeze.

The New York-based satellite radio company tumbled 10% on Friday, a day after posting its biggest surge since 2009. The stock has soared more than 90% over the past month — at least partially driven by a low liquidity rally in the heavily shorted stock.

An out-of-cycle rebalance in the Nasdaq 100 is also driving up demand for Sirius XM’s shares — exacerbated by its relatively small float, according to Jeffrey Wlodarczak, an analyst at Pivotal Research Group. The index reshuffle is set to take effect Monday and stands to boost the presence of smaller members.

All told, the shares have hit a valuation level that’s “very difficult, fundamentally, to justify,” Wlodarczak wrote in a Friday note.

Wlodarczak and Seaport Group’s David Joyce were among at least four analysts tracked by Bloomberg to downgrade their rating on the stock Friday.

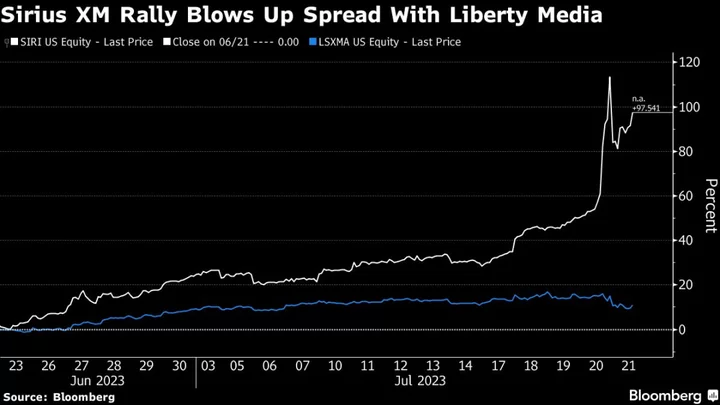

The recent jump is also creating a blowout of the stock’s spread with shares of Liberty Media Corp- Liberty SiriusXM. Liberty Media, chaired by billionaire John Malone, owns more than 80% of Sirius XM Holdings.

Liberty SiriusXM, the tracking stock, is trading at a discount of 60% compared to its estimated net asset value, according to Seaport. That’s in sharp contrast to a year-to-date average of 33%, excluding the past week’s move.

That’s a headache for traders who’ve been playing a so-called pairs trade between the two units, which requires going long Liberty SiriusXM and shorting Sirius XM.