Mercedes-Benz Group AG raised its earnings forecast for the year after profit at its vans division rose in the second quarter.

The automaker said it now expects industrial free cash flow to be “slightly above” the prior-year level, rather than in line with it. Earnings before interest and tax in 2023 will also be at the same level as last year, better than its earlier forecast for the measure being slightly below, it said in a statement on Wednesday.

The German company also said its vans unit now expects to generate an adjusted return on sales of between 13% and 15% this year, up from a previous guidance of 11% to 13%. Mercedes will report full earnings later Thursday.

Improved pricing and increased unit sales helped stave off detrimental effects from foreign exchange rates, higher costs for materials, one-time charges for commodities and higher investments, Mercedes said.

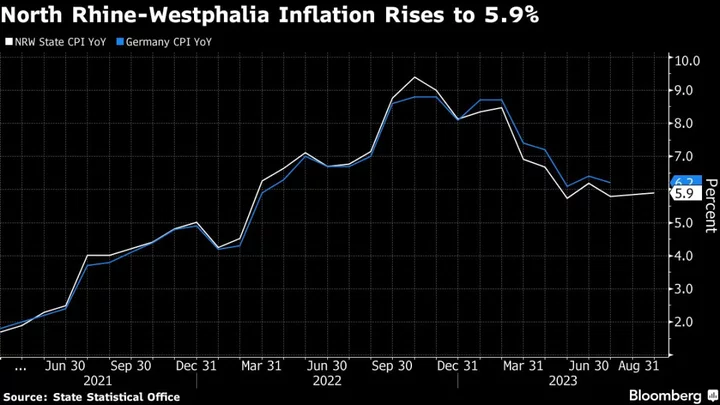

Luxury carmakers overall have held up well despite slowed growth across the industry, in part because supply problems have eased and wealthier customers are less affected by record inflation. Aston Martin Lagonda Global Holdings Plc surged Wednesday after second-quarter revenue beat targets.

Even mass-market carmakers in Europe remain bullish. Jeep maker Stellantis NV reported better-than-expected first-half results Wednesday while lifting its full-year industry views for Europe and some other regions. Renault SA, due to report earnings on Thursday, upgraded its outlook amid lower costs and strong demand for new models like the Austral crossover.

--With assistance from Albertina Torsoli.

(Updates with full earnings due later Thursday in third paragraph)