A look at the day ahead in U.S. and global markets from Mike Dolan

Labor Day comes a bit earlier for markets this year, with Friday's release of the critical August jobs report coming just ahead of Monday's end-of-season U.S. holiday.

Investors are praying the former doesn't usher in The Fall.

Judged by the torrent of labor market soundings we've seen already this week, a negative surprise from the national employment picture later on Friday seems unlikely.

Consensus forecasts for a slight slowdown in the monthly hiring pace to about 170,000 additional non-farm payrolls last month, and a jobless rate steady at just 3.5%, would tally with the picture painted by other employment measures this week.

A series of updates showed private sector hiring slowing in August, while job openings fell back in July and layoffs jumped.

On the flipside, more up-to-date weekly jobless claims fell again and the consensus payrolls estimate has ticked higher from 150,000 only last week.

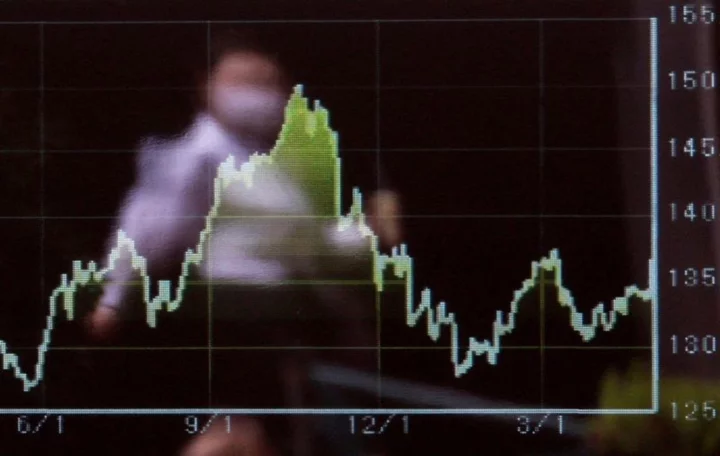

Some loosening of the super-tight labor market and ebbing of brisk wage growth is seen by many as a critical condition to stay the Federal Reserve's hand in tightening one more time this year. Going into Friday's report, futures markets remain split and stand 50-50 on the chances of another hike by November.

Although slightly dated at this stage, the July reading of the Fed's favoured PCE inflation gauge ticked higher, spending was robust and economists at JP Morgan sharply revised up their economic growth forecast for the current quarter by a full percentage point to 3.5%.

An update from the Atlanta Fed's real-time GDPNow estimate, which last week clocked an annualised growth rate for Q3 of 5.9%, will also be watched very closely later on Friday.

Beyond Wall St, which took a step back on Thursday, the broader world markets mood has picked up in the early hours of September. Helping that was another series of Chinese credit and mortgage easing and tentative signs from private surveys that factories there are finally pulling out of a slump.

Although Hong Kong was braced for the onset of Typhoon Saola, China's mainland shares rose 0.7% on Friday.

In the background, markets there are also watching embattled Chinese developer Country Garden after the firm delayed a deadline for creditors to vote on whether to postpone payments for an onshore private bond to Friday.

In Europe, investors are also split on whether the European Central Bank is done tightening ahead of this month's policy meeting, after data showed inflation remained sticky above 5% last month. A factory survey on Friday showed the downturn in euro zone manufacturing eased last month.

And whatever they think about peak rates, markets are also grappling with the prospect of rates staying up here for some time.

The International Monetary Fund's No. 2 official Gita Gopinath said the IMF expected global interest rates to remain high for "quite some time," adding that rates might never return to the era of "low for long" given the possibility of more frequent adverse supply shocks.

In corporate news, shares in Broadcom slipped 5% pre-market after its fourth-quarter revenue outlook missed forecasts overnight.

More generally, S&P500 futures were up slightly - as were European bourses. Treasury yields were steady at this week's lows and the dollar was softer. China's offshore yuan outperformed despite the loan rate cuts.

Events to watch for on Friday:

* U.S. August employment report, U.S. August manufacturing sector surveys from ISM and S&P Global, U.S. July construction spending. Canada's latest Q2 GDP estimate

* Cleveland Federal Reserve President Loretta Mester speaks, Atlanta Fed President Raphael Bostic speaks

(By Mike Dolan, mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD; Editing by Alexander Smith)