A look at the day ahead in European and global markets from Wayne Cole.

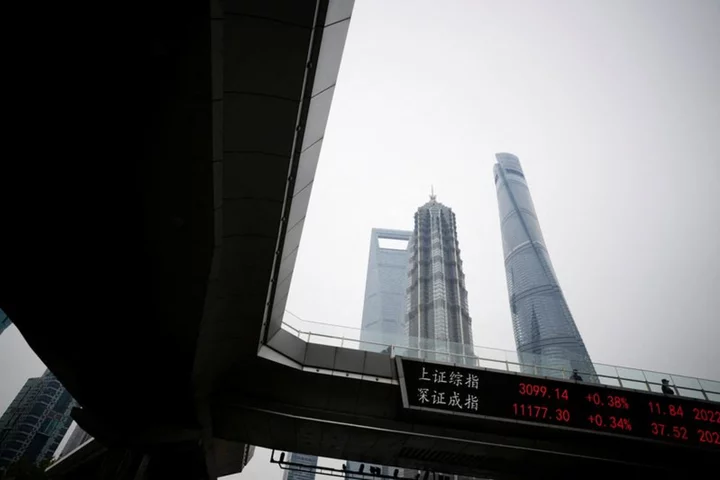

Asian share markets are looking to end July with a bang as hopes for new policy steps have Chinese blue chips up 4.8% for the month and on track for their best performance since January.

China's July PMIs were mixed with manufacturing steadying at 49.3 but services slowing to a disappointing 51.5. Yet that merely stoked wagers Beijing would have to dole up sizable stimulus at some point or risk social unrest, particularly with youth unemployment rising.

Beijing did apparently issue measures to restore and expand consumption on Monday, according to a State Council document out on Monday, though many seemed aspirational and whether they would work was an open question. So far, domestic investors seem to be giving Beijing the benefit of the doubt - foreign funds have been shunning Chinese stocks for a while.

MSCI's broadest index of Asia-Pacific shares outside Japan is also on track for its best month since January with a gain of almost 6% in July.

The Nikkei is trying for a seventh straight month of gains and is just barely in the green with a rise of 0.2% for July, though it's still up 27% year-to-date.

The market is having to contend with a rare selloff in bonds after the Bank of Japan lifted the lid on yields last week, essentially doubling it to 1.0%. That's seen 10-year yields climb 16 basis points 0.60% in two sessions, the sharpest move since the BOJ last remade its yield curve policy in December.

Higher yields could be positive for banks as they allow them to raise borrowing rates and their own margins, but they also make safe haven bonds relatively more attractive compared with riskier equities and challenge PE valuations.

Any rise in Japan's paltry yields should, theoretically, be a plus for the yen and a negative for yen-funded carry trades. Yet after its initial rally to 138.05 on Friday, the yen has since backtracked at pace to 141.68 per dollar.

Even crowded carry favourites such as the Mexican peso have brushed off the BOJ's shift, with the peso nearing its highest since 2014 after jumping 2.3% on Friday.

This in part reflects the still huge gulf between Japan rates and emerging markets and the fact that many carry trades are funded at one month rates and rolled over. Right now, investors can still borrow yen for one month at -0.1% to buy pesos and earn 11.1%.

Greater yen volatility would make those positions riskier, but it's still attractive, especially as the next BOJ meeting is almost two months away on Sept. 22. Indeed, many analysts assume any major policy change won't come until the Oct. 31 meeting when the BOJ updates its economic forecasts.

For now, it's short yen, wear diamonds.

Key developments that could influence markets on Monday:

- Flash EU GDP is seen rising 0.2% q/q in Q2, and 0.5% y/y. Annual EU inflation is forecast at 5.3% for July, from 5.5%, with the core at 5.4%, from 5.5%

- The Chicago purchasing managers' index (PMI) is forecast at 43 in July, up from 41.5 in the previous month

- Federal Reserve Bank of Chicago President Austan Goolsbee participates in a live interview

- Earnings include Western Digital Corp and the world's largest aircraft lessor Aercap Holdings NV

(Editing by Sam Holmes)