A look at the day ahead in European and global markets from Wayne Cole.

The People's Bank of China seems to like being enigmatic, throwing the market a curve ball as it fixed the yuan weaker against the dollar than many expected. Dealers had thought the firmer fix on Tuesday meant Beijing was signalling it wanted the yuan's fall to slow, or even stop. Now, not so much.

The result has been a drop in the offshore yuan back toward Monday's trough, while the market waits for some clarity on Beijing's intentions.

Sentiment was also not helped by a Wall Street Journal report that Washington is considering new restrictions on exports of artificial intelligence chips to China, which shaved 3% off Nvidia's share price.

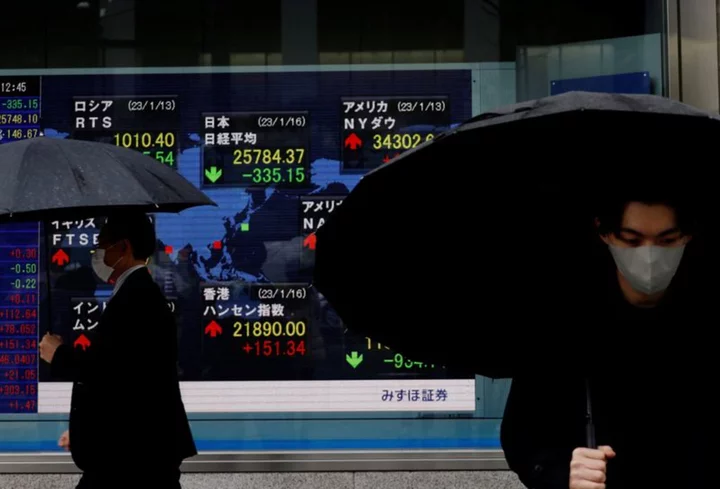

The rest of Asia would certainly appreciate a steadier yuan since its fall puts pressure on their currencies to depreciate, to keep their exports competitive with China. Malaysia is set to be the latest to intervene to support its currency, and Japan sounds closer to pulling the trigger every day.

"We are closely watching currency moves with a strong sense of urgency," Japan's top currency diplomat warned, which is about as close as the Ministry of Finance gets to an outright ultimatum.

The last time the MOF intervened, in 2022, they sold a thumping $43 billion of dollars in just two days, so the threat is not to be sniffed at. It was enough to stall the dollar at 144.0 yen, while the euro eased off a 15-year high on the yen.

Still, the market is clearly betting the yen will keep falling unless, and until, the Bank of Japan backs away from its yield curve policy. Bank of Japan chief Ueda speaks later today at the European Central Bank's Sintra jamboree, and will have to justify his super-easy policy while every other central bank on the panel is busy tightening.

It will also be interesting to see if ECB chief Lagarde expands on the idea that firms should stop padding their margins by raising prices - a variation of the argument that this is a profit-price spiral rather than a wage-price spiral.

Once this would have been scorned as a radical view of the far-left fringe, but it's increasingly gaining mainstream acceptance. An OECD study earlier this month argued that profits were a major driver of inflation, especially in the energy and agriculture sectors.

It's tempting to think that, if wages are not the culprit, then central banks might not have to push unemployment up as much as in the past to curb inflation. Yet, Lagarde's conclusion was that policy would need to be tighter for longer so as to hurt demand enough that firms restrained their hunger for profits. That's still a recipe for higher unemployment.

On the bright side, Australian data out Wednesday did show CPI inflation slowing by more than expected to a 13-month low, and that followed a sharp slowdown in Canadian inflation. So maybe there's hope yet.

Key developments that could influence markets on Wednesday:

- ECB President Christine Lagarde, Fed's Jerome Powell, BOJ Governor Kazuo Ueda and Bank of England Governor Andrew Bailey take part in ECB panel in Sintra, Portugal, 1230 GMT

- U.S. data on wholesale and retail inventories, advance goods trade balance

(By Wayne Cole; Editing by Edmund Klamann)