By Jamie McGeever

A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

Asian stocks, particularly Chinese markets, may have started the week badly but Wall Street's resilience on Monday in the face of 10-year bond yields' surge to new multi-year highs could offer some respite on Tuesday.

To be sure, there aren't many obvious reasons for the rot to stop other than the bearishness may be overdone in the short-term - the MSCI Asia ex-Japan index is down eight days in a row, its longest losing streak since January 2020, and China's blue chip index has fallen nine of the last 11 sessions.

The flow of economic data and policy actions out of China remains underwhelming. The latest figures show land sales revenues for the government fell for a 19th straight month and overall fiscal revenue growth slowed in July.

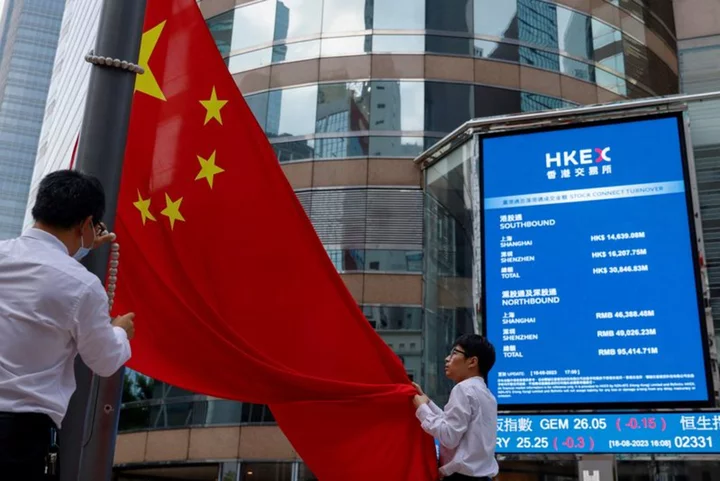

Foreigners sold Chinese stocks for the 11th day in a row on Monday, dumping nearly $1 billion via the Stock Connect, and reaction to the central bank cutting the one-year loan prime rate by 10 basis points and leaving the five-year rate unchanged was one of overwhelming disappointment.

The spread between Chinese and U.S. 10-year bonds widened to 180 basis points on Monday, the biggest gap since January 2007 and a growing source of severe downward pressure on the yuan.

State-owned banks are actively supporting the offshore yuan, sources say. If the yuan continues to fall, however, speculation is sure to mount that more direct FX intervention could follow from Beijing via the sale of U.S. Treasury bonds.

Ditto Japan and the yen, which is also extremely weak against the dollar and in territory that triggered record yen-supporting intervention late last year. Some analysts reckon Tokyo could intervene selling dollars around 150 yen, only four big figures away from the current 146 yen.

The dollar continues to draw support from the relentless upswing in U.S. bond yields. The 10-year yield rose to 4.35% on Monday, its highest since late 2007, and the real 10-year yield topped 2% for the first time since July 2009.

With the Fed's Jackson Hole Symposium looming later this week, debate among investors and analysts is intensifying around the longer-term equilibrium level of interest rates - so-called R-star - the merits of raising the Fed's 2% inflation goal, and whether the post-Great Financial Crisis of zero interest rates is gone forever.

Tech giant Nvidia's 8.5% surge on Monday, fueled by investor optimism ahead of its earnings this week, almost single-handedly boosted Wall Street and gave the Nasdaq its best day in almost four weeks.

Optimism across Asian markets is in short supply. Investors will be hoping for some spillover on Tuesday.

Here are key developments that could provide more direction to markets on Tuesday:

- BRICS leaders summit in Johannesburg

- South Korea consumer sentiment (August)

- Indonesia current account (Q2)

(By Jamie McGeever; Editing by Josie Kao)