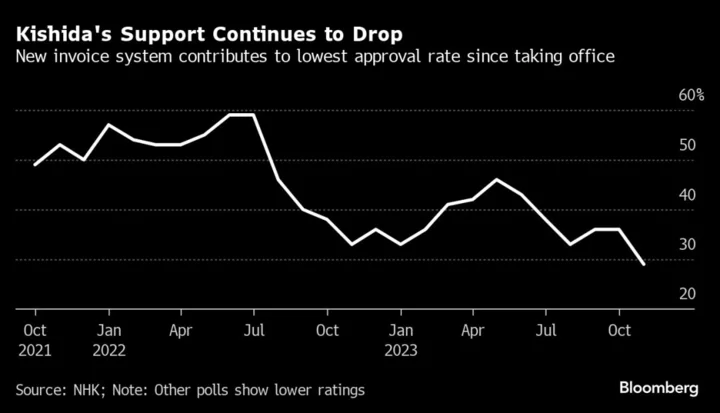

From manga artists to independent taxi drivers, Japanese freelancers and small businesses frustrated with the potential loss of a tax break are among the growing numbers pushing down Prime Minister Fumio Kishida’s approval rating to record lows.

About 4.6 million businesses that were previously exempt from paying sales tax have been impacted by a new invoice system that came into operation last month, according to the Cabinet Secretariat.

Exempt businesses that pocketed the sales tax they charged clients will now have to hand that extra income over to the government if they adopt the system. Those that don’t switch to the new procedure may lose customers or face demands to lower their prices. All those embracing the new invoices will have a lengthier billing process to follow.

The new system comes amid growing dissatisfation over Kishida’s stance on taxation, a factor that has driven down public support despite his unveiling of a ¥17 trillion ($115 billion) economic package.

“The number of people affected who think this is unfair isn’t small, so it’s one reason for his unpopularity, though not the biggest reason,” said Mari Iwashita, chief market economist at Daiwa Securities Co., referring to the invoice system.

The introduction of the new invoice system should help bring in more tax revenue for the government and will clarify whether companies have paid the full 10% sales tax rate or a lower 8% rate applied to certain goods in Japan.

Freelancers and small businesses making less than ¥10 million ($65,900) a year remain exempt from paying the tax if they stay outside the invoice system. But their clients will be less willing to shell out the levy if they can no longer include the payment in their own tax accounts.

The situation has created a movement of hundreds of thousands of independent contractors and freelancers protesting against the government. Some of the protesters marched with posters in front of Kishida’s residence at the end of September. A campaign called Stop Invoice has garnered over 560,000 signatures on an online petition so far.

Some of them argue that the extra money they get to keep without the invoice system is an important part of the income for low earning freelancers and small businesses.

“The biggest problem for us is that we’ll lose our vital assistants,” said manga artist Leon Yutaka in a speech at the protest in front of Kishida’s building. “They have very low annual incomes to begin with. If they have to pay consumption tax, they are going to start wondering why they’re even doing this job.”

Another source of frustration is the extra administrative work needed. An online poll of around 1,500 companies conducted in October by Teikoku Databank Ltd. said that over 90% of the businesses had concerns about the new setup, with 70% citing the increased workload of the billing process as the top reason.

Kishida’s government has explained that the new set up is necessary to increase transparency, especially for the transaction of goods that have the reduced tax rate. Economists say the system is largely in line with procedures overseas and helps ensure that the sales tax is getting paid by all.

Various support measures have been put into place by the government to ease the burden on businesses, such as transitional tax deductions, and the expansion of IT subsidies for small businesses who use the invoice system.

Still, the invoice system is one of the tax issues weighing on Kishida’s popularity.

Opinion polls over the weekend showed Kishida’s support dropping into the lower half of the 20% range. A government move to return a portion of income tax has drawn unexpected criticism from voters unhappy that it won’t deliver any cash until early next summer.

The surveys showed respondents are also concerned about the impact of the tax rebate on Japan’s finances, with long-term funding still undecided for Kishida’s ramped-up spending on defense and measures to raise the nation’s birthrate.

The new invoice system is estimated to increase tax revenues by about ¥248 billion ($1.6 billion) according to 2019 data from the Ministry of Finance, so it’s unlikely Kishida will consider any U-turn.

“As social security costs increase due to the rapidly aging population, consumption tax is seen as a source of revenue that will be broadly and fairly shared among all generations,” Kishida said in parliament last month. “Thus, we do not plan to lower the sales tax rate, or scrap the new system.”

--With assistance from Isabel Reynolds.