Man Group Plc has appointed its first female chief executive officer in its 240 years of existence.

Robyn Grew will take over from Luke Ellis, 60, who is stepping down from the helm of the world’s largest publicly listed hedge fund firm on Sept. 1, according to a statement Thursday. Grew, who joined Man Group in 2009 and is currently its president, will move to the UK for the role but will continue to spend a substantial proportion of her time in the US.

“Robyn is a dynamic, strategic leader with deep operational and commercial expertise, who knows the firm inside-out and is the perfect fit to take the firm on the next phase of its journey,” John Cryan, chairman of Man Group said in the statement.

The decision follows the firm’s appointment of Anne Wade as its first female chairman to replace Cryan, who is retiring towards the end of 2023, according to a separate statement in February.

At the thousands of hedge funds and other alternative investment firms globally, women make up only 21.3% of employees, according to a report by Preqin in March. They only occupy 13.6% of senior roles and the proportion of female board members is lower still, at 10.3%, the data provider found.

Some progress have been made in pockets of the industry. Mala Gaonkar’s SurgoCap Partners started her hedge fund with $1.8 billion under management, the largest debut for a woman-led hedge fund ever.

Man Group was founded in 1783 by James Man as a barrel maker-cum-brokerage on Harp Lane, about 500 meters from its current office along the Thames in London. Over the next two centuries, it supplied rum to the Royal Navy and traded commodities such as coffee and sugar before eventually focusing exclusively on financial services.

The firm has recently been defying a trend of outflows from the hedge fund industry and attracting clients through its range of funds from long only to alternative money pools. Clients allocated a net $1.1 billion to its funds in the three months through March, beating analyst estimates.

Read more: Man Group Pulls in $1.1 Billion, Defying Industry Outflows

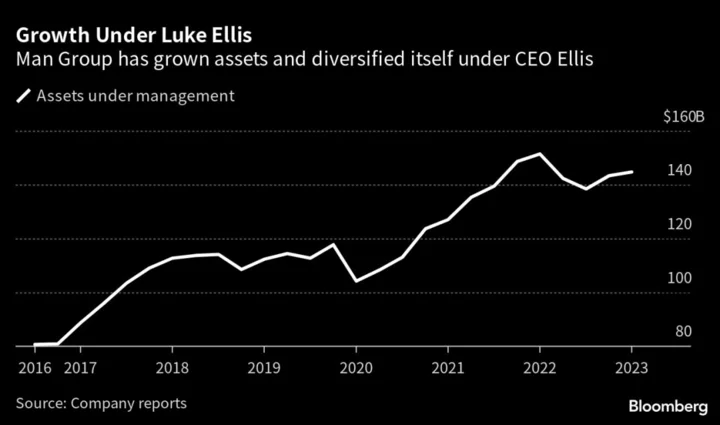

Ellis took over as CEO in 2016. Under his leadership, the firm has strengthened its offerings and transformed itself into a diversified asset manager. Assets have grown to about $145 billion from about $81 billion when he took over.

Before joining the firm in 2009, Grew held senior positions at Barclays Plc and Lehman Brothers as well as at LIFFE, the largest futures and options exchange in London - since renamed the ICE Futures Europe, according to the statement.

--With assistance from Tom Metcalf.