Malaysia’s central bank is expected to keep borrowing costs steady even up to 2025 as price pressures diminish and economic growth stays resilient, according to a Bloomberg survey.

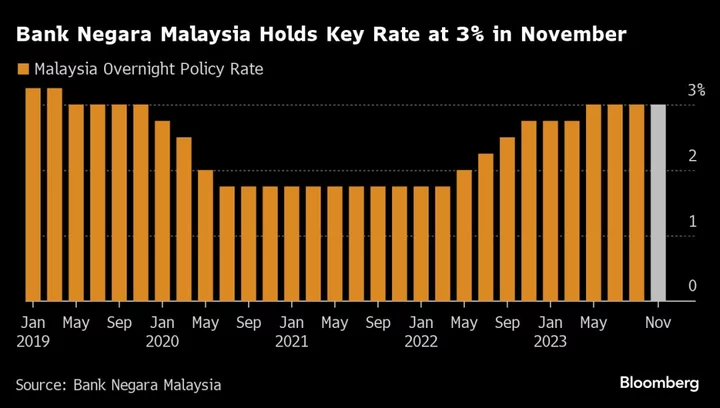

Bank Negara Malaysia will maintain the overnight policy rate at 3% at least for the rest of the coming year, extending a rate pause that started in July 2023, according to the majority of 26 economists surveyed in the past week. Their outlook on inflation and economic growth were largely in line with government estimates.

While inflation isn’t a worry as the headline gauge cooled to a two-year low, Malaysian policymakers are confronted with a persistent weakness in the local currency. At the same time, a recent survey showed a rising dissatisfaction with the government’s handling of the economy, dragging down Prime Minister Anwar Ibrahim’s approval rating.

The premier last month said he sees no need to raise interest rates to shore up the ringgit. BNM Governor Abdul Rasheed Ghaffour has reiterated that the central bank is committed to ensure that the ringgit moves in an orderly manner. Last month, the governor also said monetary easing “is not on the cards at the moment.”

Malaysia’s ringgit has weakened 5.9% against the US dollar year-to-date, making it the second-worst performer in Asia after Japan.

Price pressures in Malaysia have been cushioned by blanket subsidies that the government plans to gradually phase out. Economists cut their inflation forecast for the year to 2.6% from their previous estimate of 2.9%, while the 2024 outlook remains unchanged at 2.5%, according to the survey. They see growth of 4.5% next year from a projected 4% expansion in 2023, in line with the government’s projections.

“With a still robust private consumption and a slight recovery in exports, Malaysia’s economic momentum should quicken in 2024,” said Eve Barre, Asia Pacific economist at Coface. The prospect of higher growth and inflation next year leaves little room for the central bank to cut rates, she said.

In the Bloomberg survey, 21 out of 26 economists expect the BNM to keep the key rate unchanged, with 5 of them seeing a hold until 2025. Four analysts forecast a cut while one predicts a hike next year.