French President Emmanuel Macron has invited about 200 global business leaders to Versailles on Monday, showcasing his foreign investment pulling power as he attempts to reboot his second term in office after a damaging battle over pension reform.

Macron is expected to meet with chief executives including Pfizer Inc.’s Albert Bourla and Walt Disney Co.’s Robert Iger at the vast palace that Louis XIV made the seat of French power.

On Sunday, industry minister Roland Lescure told France Info radio that a €710 million ($770 million) investment in a solar panel plant in eastern France would officially be announced during the event.

The “Choose France” summit comes after the French leader traveled to Dunkirk, in northern France, on Friday to confirm ProLogium Technology Co. — a Taiwanese battery maker that attended a similar event at Versailles last year — will invest as much as €5.2 billion to build a factory in the region.

Macron said that investment projects to be announced on Monday will total more than €10 billion, trumping all previous editions of the summit, which he first convened in January 2018 to catch C-suite executives en route to the Davos World Economic Forum.

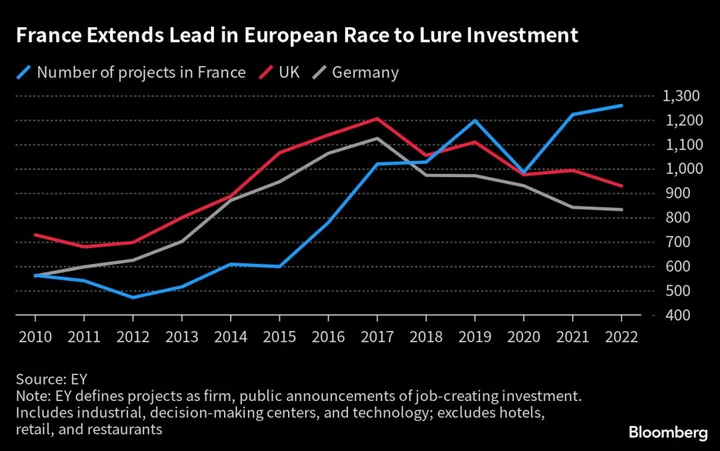

Embracing foreign capital has long been Macron’s trademark economic policy, and there are plenty of signs the strategy has paid dividends in the past six years. France continues to top rankings for attracting investment, its unemployment rate has fallen, and economic growth has been resilient through the Covid years and energy crises.

His pro-business approach — built on loosening labor laws and cutting taxes — is increasingly unpopular with French people, however. Tensions boiled over earlier this year when Macron’s move to raise the retirement age sparked mass protests as labor unions argued it was a step too far in shifting burdens to workers instead of companies and the wealthy.

“Aid for businesses have risen by 20% these last few years and that’s why the retirement age has been raised, in order to finance all that,” Marine Tondelier, head of the green party EELV, told the France 3 Television channel on Sunday.

The political situation has also caught the attention of investors, and last month Fitch Ratings downgraded France’s credit rating, warning that deadlock and protests pose a risk to the French leader’s reform agenda.

“We have done an ensemble of reforms to be more competitive, and the pension reform, which is so unpopular, is part of that,” Macron told workers at an aluminum factory during his visit to Dunkirk. “If we don’t do all that, we won’t be able to re-industrialize.”

Investment commitments announced at previous summits haven’t always materialized, and sometimes the pledges have included elements already decided by companies. The biggest tickets expected on Monday include €500 million from Pfizer, €400 million from GSK Plc, and €910 million from Ikea, according to officials from Macron’s office.

--With assistance from Francois de Beaupuy and Ania Nussbaum.