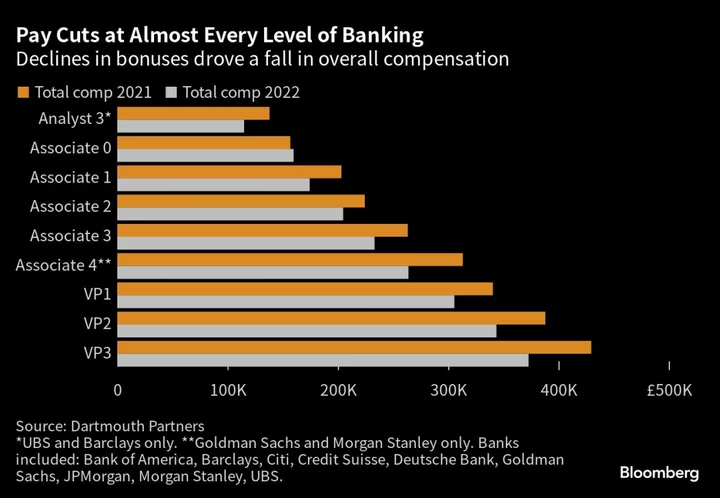

The slump in dealmaking cut pay for investment bankers at almost every level of seniority in London last year.

The highest tier of vice presidents made 13% less, and all but the most junior associates saw their total compensation fall, according to a survey of about 250 bankers by global recruitment consultancy Dartmouth Partners.

While base salaries generally continued to rise, bonuses were slashed as staff shared in a smaller pool of deal fees. The M&A drought has continued into this year, resulting in a wave of redundancies across multiple countries.

Remuneration for UK-based bankers at Goldman Sachs Group Inc. — the best-paying investment bank in 2021 — fell the hardest in 2022, with associates’ total compensation down 28% and VP pay falling almost 25%.

While it remains one of the most competitive for pay, particularly for experienced staff, the Dartmouth survey found that Wall Street rivals Bank of America Corp., JPMorgan Chase & Co. and Morgan Stanley were offering more at certain pay grades.

Credit Suisse was near the bottom of the pack in the year before its rescue sale to UBS Group AG, with associate pay falling by 18%, while VP compensation dropped by 29%, according to the survey.

Read more: Goldman Led Way With Bumper Pay for London Dealmakers in 2021

Global M&A activity fell by more than a third during last year, according to Bain & Co. data, as geopolitical tensions, stubborn inflation and soaring interest rates discouraged corporate risk-taking. The first half of this year brought a further 42% decline according to data compiled by Bloomberg, making it one of the worst periods for deals in a decade.

While some bankers had to deal with lower bonuses, others are losing their jobs altogether. Goldman Sachs, JPMorgan, Bank of America, Morgan Stanley and BlackRock Inc. are among those to have gone through rounds of cuts, while UBS is expected to jettison more than half Credit Suisse’s 45,000-strong workforce.

Given the tough environment, bankers at the biggest firms “are largely willing to accept lower than hoped-for compensation based on the current market conditions — but only if their banks can effectively temper expectations and demonstrate the reasons for any lower than anticipated pay,” the report’s authors wrote.