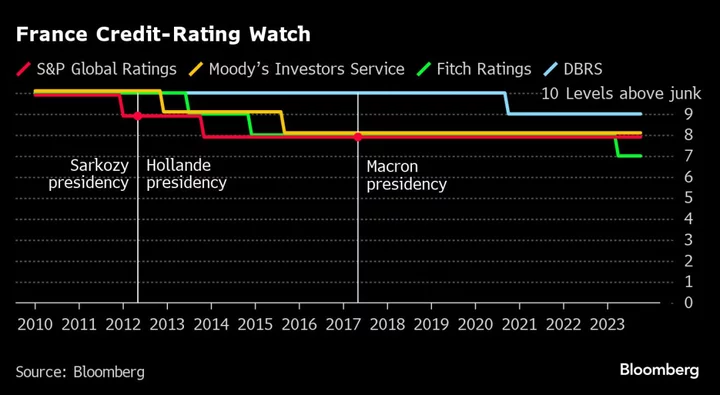

French Finance Minister Bruno Le Maire warned that the country’s borrowing costs would rise if it is downgraded by S&P Global Ratings next week.

S&P already has a negative outlook on its assessment of France and could cut its rating Dec. 1 shoult it take a dim view of economic prospects and the government’s efforts to repair finances after huge spending during the Covid and energy crises.

“Of course the risk exists, I’m perfectly aware of that, which is why I am intransigent on reducing debt and deficits” Le Maire said on France Info radio. “If our rating was downgraded tomorrow, that would mean interest rates would be higher again, we’d borrow at higher cost, and throw billions of euros out the window to pay interest.”

In April, Fitch Ratings reduced France’s credit rating to AA- from AA, saying projected budget deficits for this year and next year “are well above” the median for similar rated sovereign borrowers.

Le Maire said he has taken the necessary decisions to avoid a downgrade by ensuring that the budget deficit will decline to 4.4% of economic output in 2024 from 4.9% this year.

“That means having well managed public finances and respecting our commitments to French people, European partners, and markets,” Le Maire said. “The words of the finance minister are credible and I hope we’ll win the belief of rating agencies.”