Land Securities Group Plc marked down the value of its UK real estate portfolio by £848 million ($1.1 billion) last year even as rents for its offices and stores rose.

The UK real estate investment trust wrote down its portfolio by 7.7% to £10.2 billion in the year through March, according to a statement Tuesday. The writedown pushed LandSec to a £622 million loss, though asset sales helped reduce its relative indebtedness to 31.7% from 34.4% a year earlier.

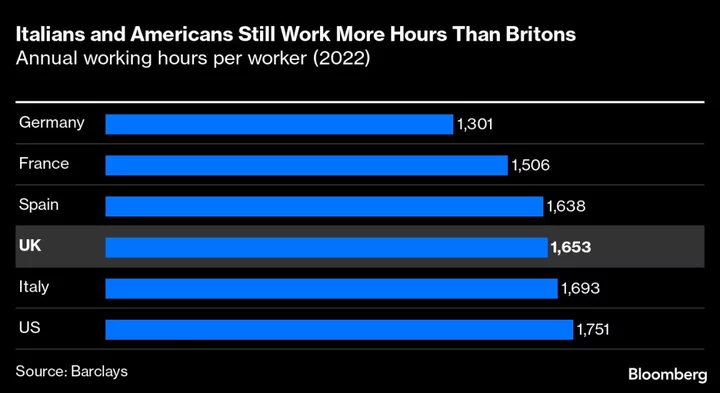

Landlords are grappling with sharply higher borrowing costs that have begun to feed through to property prices, ending more than a decade of cheap money that inflated asset values. Still, demand for the best-quality green office space is outstripping supply after years of muted construction levels, supporting higher rents for the type of new buildings developed by LandSec.

Landsec reported like-for-like rental income increased 6% in the period.

“In the last six months we’ve seen rates rise more rapidly than rents have been able to and so the pressure has been downwards on values,” LandSec Chief Executive Officer Mark Allan said in an interview with Bloomberg Television. “It feels much more finely balanced now, but investment markets are still relatively thin in terms of transactions.”

What Bloomberg Intelligence Says:

Landsec’s strategic positioning may enable the REIT to weather the continued challenges to portfolio value presented by the rapid rise in UK interest rates and resetting of property yields, yet further attrition in its net tangible assets appears inevitable.

— Sue Munden, BI real estate and REIT analyst

LandSec rose in early London trading, up 1.6% at 8:55 a.m.

--With assistance from Anna Edwards and Mark Cudmore.

(Updates with CEO comment in the fifth paragraph, BI comment in the sixth and share price move in the final paragraph)