The European Central Bank is now at a point where it can pause and assess the impact of its tightening, according to President Christine Lagarde.

“We have already done a lot,” Lagarde said. “Given the amount of ammunition we have used, we can observe very attentively the components of our lives like salaries, profits, like fiscal, like geopolitical developments and certainly the way in which our ammunition is impacting our economic life to decide how long we have to stay there and what decision we have to make — up or down.”

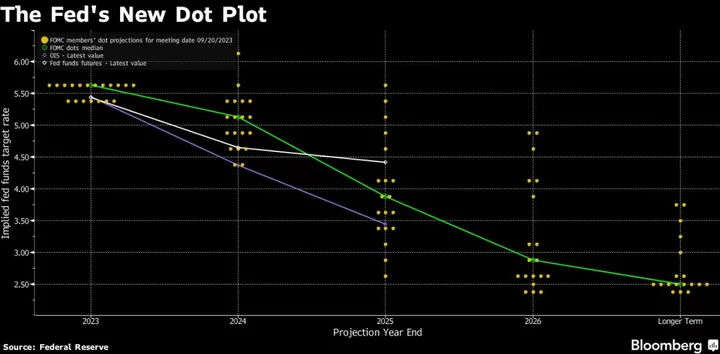

The ECB kept interest rates on hold last month, saying they’re now at a level that will help bring inflation back to the 2% target if maintained for long enough.

There’s increasing evidence that the unprecedented tightening campaign that started in mid-2022 is impacting the economy. Output in the 20-nation euro area shrank 0.1% in the third quarter, though the European Commission said last week it will probably avoid a recession because consumers’ improving purchasing power will drive a modest rebound.

Speaking in S’Agaro, Spain, on Friday, Vice President Luis de Guindos sounded less sure. He said that the euro-area economy is probably stagnating, but highlighted that risks to the current growth outlook are to the downside.

ECB Governing Council member Pablo Hernandez de Cos told the same event a few hours later that there’s the possibility of a recession in the euro zone.

After a 2.9% inflation reading in October, this month will probably show another slowdown, but officials have cautioned that it may pick up again in the short term due to statistical effects. It’s only forecast to hit the ECB’s goal in the second half of 2025.

“The battle is not over and we’re certainly not declaring victory,” Lagarde said at a Bundesbank youth event in Frankfurt on Friday, vowing to get consumer-price growth back to target.

An account of the most recent policy meeting published Thursday revealed that officials agreed that they should be ready to hike again if needed — even if this isn’t their baseline scenario.

Bundesbank President Joachim Nagel reaffirmed that view on Thursday, saying it would be “a mistake” to start loosening monetary policy too early. Similarly, Governing Council member Gabriel Makhlouf said he doesn’t rule out “another rung” and that it’s “far too early” to start talking about rate cuts.

The market disagrees and is betting on rate reductions as soon as April. To materialize, that would probably require a serious downturn in the euro-area economy.

--With assistance from Rodrigo Orihuela.

(Updates with de Cos in sixth paragraph)