Kroger Co. said it’s committed to hunkering down for a long legal battle if US regulators attempt to block its $24.6 billion acquisition of Albertsons Cos.

“Usually you wouldn’t commit in advance to litigate. In this case we both committed to litigate in advance,” Kroger Chief Executive Officer Rodney McMullen said in an interview Wednesday at Bloomberg headquarters in New York.

That doesn’t mean Kroger necessarily expects antitrust regulators at the US Federal Trade Commission to oppose the deal as the company pushes to complete it early next year, McMullen said. The Cincinnati-based grocer has been holding discussions with the FTC about the agreement and the process is “where we thought we would be at this time,” he said.

“We believe very strongly that we had the best professional advisers, and Albertsons had the best professional advisers, on being able to find a viable solution,” McMullen said. A successful outcome would mean that “the combined company will create the right environment and lower prices, and we’ll be able to divest stores to somebody that’s good.”

Kroger and Boise, Idaho-based Albertsons are in talks with possible buyers as the grocers seek to divest as many as 650 stores. But it’s too early to say whether they will seek to sell everything to a single buyer or offload stores to multiple companies.

McMullen said he believes there’s a “meaningful number” of potential buyers that could purchase stores without taking on too much debt, including private equity companies and existing retailers. He also continues to weigh spinning off stores from the combined total of almost 5,000 Kroger and Albertsons locations.

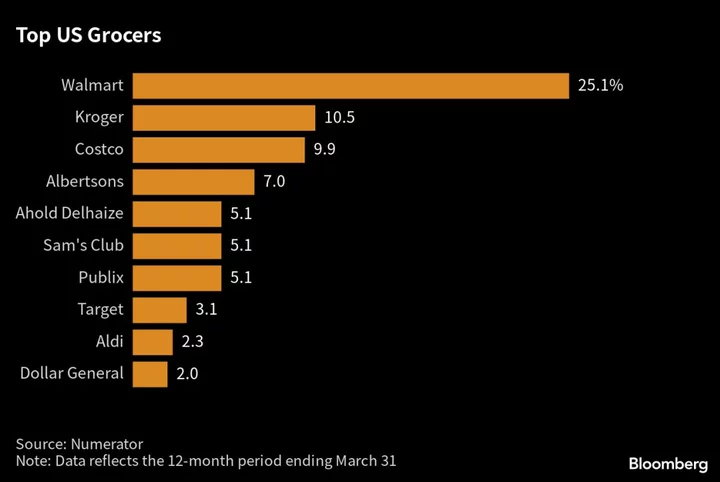

One bone of contention is likely to be how the FTC defines the market in which Kroger and Albertsons compete. Traditionally, the regulator has looked store by store at the location of competitors like other supermarkets and Walmart Inc.’s supercenters, but excluded online or other retailers like convenience stores.

Kroger is arguing for a broader definition that includes Amazon.com Inc., warehouse clubs such as Costco Wholesale Corp. and discounters such as Dollar General Corp., Dollar Tree Inc., Aldi and Lidl. While once-a-week trips to the grocery store used to be common, today’s consumers typically visit three to four stores to do their weekly shopping, he said.

“If you go back 10 or 15 years and look at a Kroger business plan strategy meeting with the board, the conversation would have been probably 60% about Walmart,” said McMullen, 62, who joined Kroger as a part-time stock clerk in 1978 and took the reins as CEO in 2014.

These days, he said, Walmart “would continue to be a part of that, but we would look at dollar stores, the Aldis and the Lidls of the world, we’d look at Costco, obviously Amazon and then restaurants.”

Amazon Potential

Amazon is also a potential buyer of stores from Kroger and Albertsons, McMullen said. In a letter to Amazon shareholders last month, CEO Andy Jassy committed to continue investing even as the company has cut back on some projects. Jassy highlighted grocery as an area of interest despite a pause in the expansion of the Amazon Fresh mass-market grocery brand while the e-commerce giant reevaluates the stores.

The online retailer needs “a broader physical-store footprint given that most of the grocery shopping still happens in physical venues,” Jassy wrote. “We’re working hard to identify and build the right mass grocery format for Amazon scale.”

For Kroger, combining with Albertsons would round out its national footprint despite overlap in some markets, McMullen said. The deal would also improve Kroger’s ability to compete as Walmart and Amazon invest in their distribution networks and build lucrative digital advertising businesses.

“We’re focused on, if you look at five or 10 years out, who’s your competitor?” he said. “And how do you make sure you have a company that you can afford to invest in technology, afford to invest in supply chain, afford to continue to invest in wages and benefits?”

--With assistance from Simone Foxman and Matt Day.

(Updates with additional CEO comments starting in eighth paragraph.)