South Korea wants brokerages to swap short-term risky property debt for longer term borrowings, in bid to counter risks in the real estate market and avoid a repeat of last year’s turmoil.

The country’s financial regulator unveiled what it termed preemptive steps to counter a rise in loan delinquencies and address maturity mismatch between the long-running real estate projects and the short-term debt to finance them.

Officials want firms to convert their project-financing asset-backed commercial paper into loans with tenors in line with the time line of the underlying real estate projects. They will encourage the step by lowering the risk-weights on capital ratios, according to a joint statement by Financial Services Commission and Financial Supervisory Service.

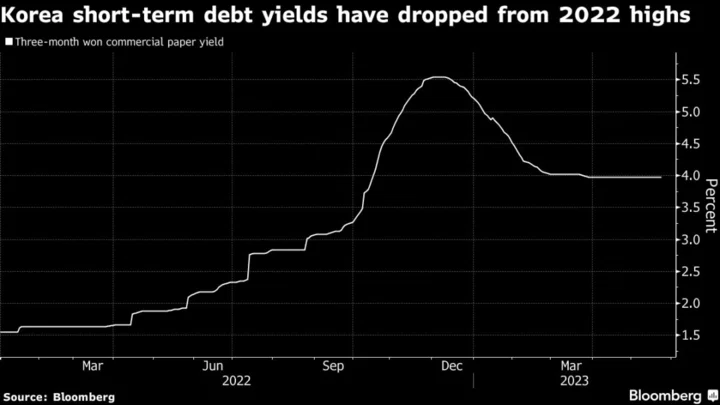

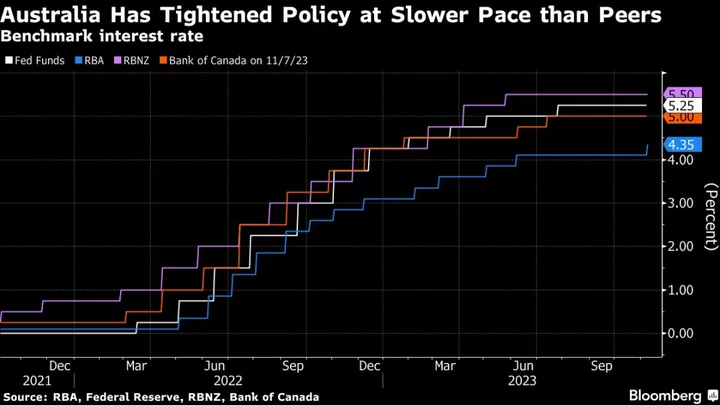

Korea was among the first countries to feel the effects of the global policy tightening, when a property developer’s missed debt payment last September set off a broad corporate bond market rout and intensified scrutiny of the country’s project finance system for real estate.

Korea’s debt markets stabilized after authorities pledged billions of dollars in support. But risks still linger, given the uncertainties about the path of interest rates globally, the FSC said on Wednesday.

At the heart of the problem officials are looking to address is the fact that Korea’s brokerages typically securitize long-term project financing loans into short-term debt known as project-financing asset-backed commercial paper, or PF-ABCP. But there’s a maturity mismatch between the underlying assets, which typically have a three-year tenor, and commercial paper, usually issued for no more than three months.

That means that if interest rates rise, an issuer can suddenly face a surge in funding costs.

The exposure of brokerages to PF-ABCP totaled about 20.8 trillion won ($15.8 billion) at end-March, the FSC said.

Securities firms’ delinquency ratio on project financing loans surged to 10.38% at end-2022 and the ratio may continue to rise, according to the regulator’s statement.

The program to buy PF-ABCP launched late last year by brokerages will also be extended to end-February, the FSC said. Authorities will also encourage brokerages to swiftly write off non-performing loans to manage their soundness.

--With assistance from Shinhye Kang.