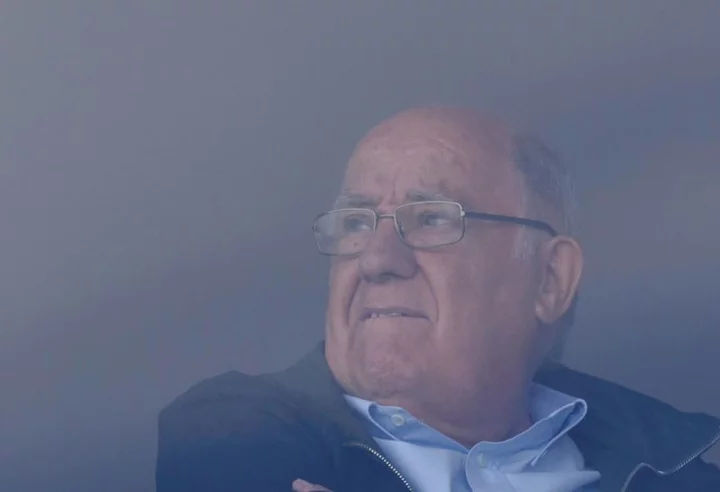

JCPenney CEO Marc Rosen sees plenty of evidence that working-class families are struggling.

Customers are increasingly relying on credit cards, falling behind on bills and flocking to private label brands like Liz Claiborne instead of pricier national ones, Rosen told CNN.

"Our customers are America's working families. They're the teachers teaching our kids in schools, the construction workers building our homes and medical workers taking care of us," Rosen said in an interview last week. "And that customer is facing a tougher economic environment."

The JCPenney CEO pointed to the snowballing effect inflation has had on family budgets, noting that the typical household is spending about $700 more per month than they did two years ago for the same goods and services.

"That's tough for a family like that because it means they're making tradeoffs in everything that they can do," Rosen said.

Rosen sees evidence of this financial stress in the "very strong" growth of the department store's private brands, which are priced lower than national brands. He pointed to strong private brand sales for apparel as well as for home goods like cookware and small appliances such as blenders and toasters.

Likewise, Rosen said that while JCPenney maintains a "strong" portfolio of company-branded credit cards for its customers, credit usage has gone up and the pace of delinquencies has increased back to where it was before Covid-19.

That jives with what other retailers have said. Rival Macy's recently sounded the alarm on rising credit card delinquencies and the New York Federal Reserve similarly found that the rate of new credit card delinquencies has climbed above mid-2019 levels.

The comments from JCPenney demonstrate the confusing state of the US economy. Even though the risk of a recession has fallen and the jobs market remains healthy, some consumers are hurting.

Just last week, Dollar General slashed its sales and profit outlook for the year, citing core customers that feel "financially constrained." Bank of America recently found that Americans are tapping their 401(k) accounts due to money troubles.

Yet JCPenney argues these economic challenges play to the 121-year-old company's strengths.

"I absolutely believe that this is a take-share moment right now," Rosen said. "We believe customers deserve a shopping experience where they don't have to make those tradeoffs, where they can still get that great fashion without paying a price that makes it hard to put groceries on the table."

That's why JCPenney is pumping $1 billion of upgrades through the aging company. The self-funded reinvestment program includes everything from new merchandising tools aimed at expediting its supply chain to updates at its more than 650 stores, including new technology, fitting rooms and even a fresh coat of paint.

The $1 billion reinvestment marks a big moment for an iconic company that filed for bankruptcy in May 2020. Thanks to a rescue from mall owners Simon Property Group and Brookfield Asset Management, JCPenney was able to emerge from bankruptcy later that year and it remains private.

"We're in a really strong financial position right now, with a clean balance sheet and strong cash flow funding the operations of the business," Rosen said, adding there are no major store-closure plans in the works.

The JCPenney CEO wouldn't directly answer whether the department store plans to return to the public markets through an initial public offering. But he signaled an IPO isn't in the immediate future.

"We think there are a lot of advantages right now to being a private company," Rosen said, noting that JCPenney's owners are reinvesting in the company and are taking a "long-term perspective" on that investment.