Japan’s biggest banks raised their overseas bond holdings by $27 billion in the three months through March, underscoring their need to deploy cash even as they seek to shift out of underperforming securities.

The foreign bond portfolios of Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. collectively rose to 44.3 trillion yen ($325 billion) at the end of March, from 40.6 trillion yen three months earlier, according to their earnings presentations on Monday.

MUFG and SMFG led the increase, with the latter saying it added mortgage securities. Mizuho slightly reduced its portfolio. The banks did not say how much of the move was linked to gains in markets.

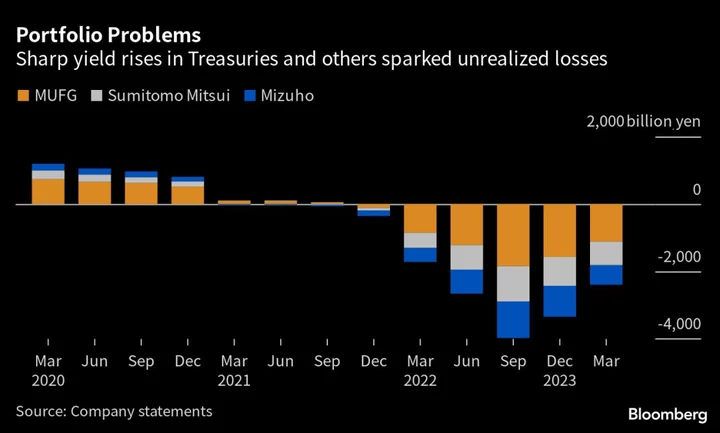

The holdings have been hit by a wave of interest rate hikes by major central banks since last year, sparking elevated levels of unrealized losses. The additional purchases show how Japan’s banks are persisting with investing a significant portion of their securities portfolio overseas in a bid to raise returns amid ultra-low interest rates in Japan.

Read More: Japan’s Banks Resist Buybacks After Predicting Bumper Profit

Compared with a year earlier, the foreign bond holdings of MUFG fell, while those at SMFG and Mizuho rose.

Unrealized losses on foreign bonds narrowed for the second successive quarter to about $17.6 billion at the end of March, according to results filings. That was a reduction of roughly $7 billion from the end of December, as the three banks moved to clean up their portfolios for Japan’s fiscal year that started in April.

While the size of unrealized losses isn’t a major threat to the viability of Japanese banks, they’ve been seen as dead weight since money is tied up in bonds that generate low returns when funding costs are rising and there are better investment opportunities.