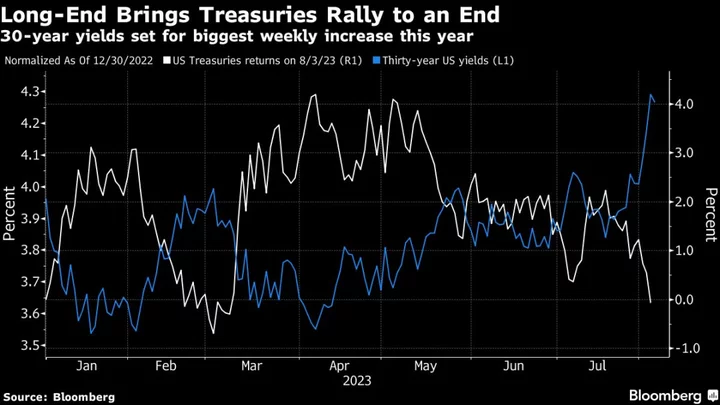

Japan’s 10-year government bond yield reached a new nine-year high Tuesday amid upward pressure in global interest rates.

The yield increased to 0.66%, the highest since 2014, raising the prospect that the Bank of Japan may come into the market with an unscheduled bond-buying operation to slow gains.

Investors are trying to gauge the central bank’s tolerance for yield spikes after it waded into the market twice since adjusting policy on July 28. That tweak was to allow the rate on 10-year debt to eventually rise as high as 1%, but not rapidly.

Rising US Treasury yields along with elevated inflation at home have kept upward momentum on yields and pressure on the BOJ to further tweak its ultra-easy monetary policy.

The Treasury 10-year yield is around its highest level since 2007 at 4.35% as the persistently resilient US economy has investors positioning for interest rates to remain high even after the Federal Reserve winds up its hikes.