Japanese workers’ wages jumped by more than twice the pace expected by economists as annual pay hikes fed into monthly data, offering the central bank a sign that upward momentum in pay may be strengthening.

Nominal cash earnings for Japan’s workers rose 2.5% in May from the previous year, the labor ministry reported Friday. The results blew past analysts’ expectation of a 1.2% gain, and may maintain market speculation that the Bank of Japan will consider adjusting policy sooner rather than later.

The gains still left households worse off as pay failed to keep up with rising prices, a factor that will likely weigh on consumption. Real cash earnings fell 1.2% from a year earlier in May though decreasing less than economists forecast.

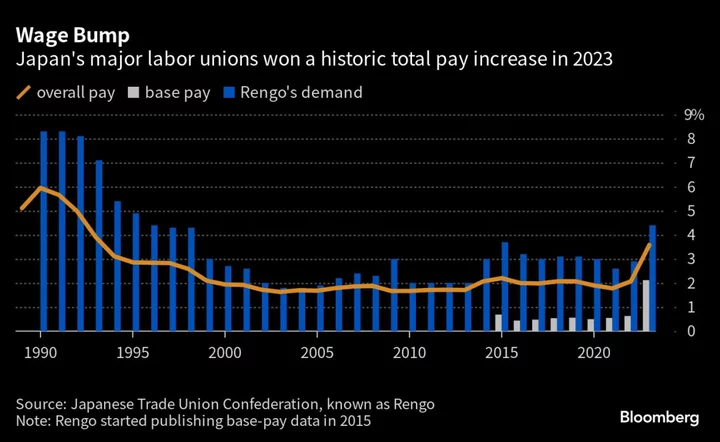

Friday’s figures indicate that the strong results of this spring’s wage negotiations are finally lifting monthly pay as upward momentum builds. Japan’s major labor unions secured a 3.58% total pay increase through this year’s wage talks, the biggest increase in decades, according to the final tally released Wednesday by Rengo, the country’s largest union federation.

The unexpectedly strong figure could strengthen the view that the BOJ might consider a policy adjustment in the near future without waiting to see the results of next year’s wage negotiations. The BOJ is closely following wage figures to see if there’s a lasting change in the trend that could support its goal of achieving stable inflation.

“The spring wage negotiations clearly lifted base pay, and we’re seeing that reflected in the May wage figures. It’s a positive factor for the BOJ,” said Moe Nakahama, a research associate at Itochu Research Institute.

The wage gains were also solid for a subset of samples that more reliably shows Japan’s pay trend, rising 2.1% from the previous year. Bonuses jumped more than 20%, but base pay also showed solid increases in a clear sign of the spring wage talk results now being reflected in salaries. Still, the monthly wage data tends to be volatile, and it is difficult to draw strong conclusions from one set of figures.

While the consensus view is that the central bank won’t budge on policy until later in the year or next year, a third of economists polled at the beginning of June forecast the BOJ to take action at its meeting at the end of this month.

The wage data “reminds people of the possibility of yield curve control adjustment at the July meeting,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities, while sticking with her view that change will come in October. “We’ve been able to confirm what Governor Ueda refers to as ‘emerging green shoots.’”

At the same time, rising prices have been eroding consumers’ spending power. A separate report showed that Japanese household outlays declined for a fourth month, down 4% in real terms from a year ago. Sluggish consumption bodes ill for Japan’s recovery and growth trajectory, given it accounts for more than half of the country’s gross domestic product.

Continued price gains are likely to keep fueling speculation over policy change. The latest data for the Tokyo metropolitan area, a leading indicator for the national trend, showed the key inflation gauge reached 3.2% in June. Economists widely believe that the bank needs to revise its price outlook in its July report to account for the strength of underlying inflation.

While Governor Kazuo Ueda has struck a cautious tone in recent weeks, developments in wages and a further weakening of the yen could move the central bank toward considering change.

What Bloomberg Economics Says...

“The Bank of Japan may be clearing the first hurdle to achieving its 2% inflation target. We still expect the BOJ to keep policy steady at its July meeting. After all, this is one month’s set of data. Even so, we think the faster wage growth will convince the BOJ that the chances of achieving its inflation target have increased.”

— Taro Kimura, economist

For the full report, click here

From April, the BOJ has made a stronger point of the need for wage growth to accompany stable inflation in its policy statement, although Ueda has been careful to point out that policy decisions are made on a number of different factors.

“Japan’s economy is showing signs of entering into a virtuous economic cycle between inflation and wage growth,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence.

“Still, I don’t think we are where the BOJ can say that its price target will be achieved with conviction. It remains uncertain if inflation will pick up after an expected slowdown later this year. Lacking enough data to change its view, chances are low that the BOJ will adjust policy at its July meeting,” Taguchi said.

--With assistance from Toru Fujioka and Masahiro Hidaka.

(Updates with more economist comments)