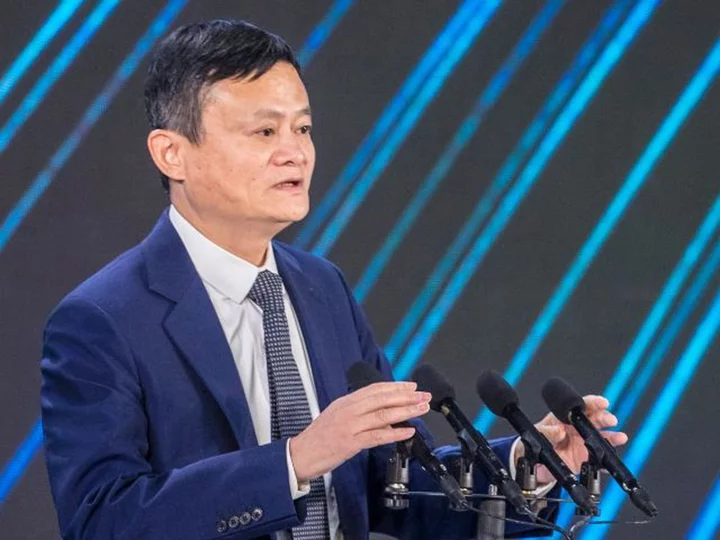

Jack Ma's fortune is estimated to be worth less than half of what it was just three years ago, when he made a pivotal speech that derailed what was supposed to be the world's biggest share sale at the time.

The Bloomberg Billionaires Index projected Wednesday that the business mogul's wealth had fallen by $4.1 billion over the past year, due to a massive fall in the valuation of Ant Group, the fintech giant that he co-founded but no longer controls.

Ma, who also co-founded e-commerce firm Alibaba, has a 9.9% stake in Ant, according to Bloomberg.

The entrepreneur, once Asia's richest person, now has a net worth of approximately $30 billion, less than half of the $61.2 billion peak recorded in 2020 before he ran into trouble that year, according to the index.

Ant, best known for running the Alipay digital payments system that is ubiquitous in mainland China, is conducting a share buyback that values it at $78.5 billion, down 75% or $230 billion from its valuation in 2020.

The combined loss of market capitalization for Ant and Alibaba totals some $877 billion, according to a CNN calculation based on peak share prices recorded in late October 2020, around the time the entrepreneur blasted Chinese financial regulators and banks in the landmark speech.

Ma's criticism, delivered just days before Ant was set to list in Shanghai and Hong Kong, kickstarted an unprecedented crackdown on private enterprise in China, which led to heightened regulatory scrutiny of other tech companies around the country.

Chinese regulators pulled the plug on Ant's $37 billion IPO in November 2020 and ordered the company to restructure its business.

Since then, Ma has kept a very low profile. In recent years, he has reportedly spent time in Japan, home to his friend and Alibaba investor, SoftBank CEO Masa Son, and in Hong Kong. He has also started a new gig as a visiting professor at a Tokyo university, and spent more time on philanthropy.

He has also stepped back from the companies that he started.

In January, Ma gave up control of Ant after it spent two years revamping its business from consumer lending to insurance products at the behest of regulators. He had stepped down as chairman of Alibaba in 2019, when he turned 55.

Ant and its units were also fined $984 million by Chinese financial regulators last week, for allegedly breaking rules related to consumer protection and corporate governance. Analysts said the fines were a sign that the regulatory crackdown had finally ended.

In March, Alibaba announced plans to split up into six separate units, each overseen by its own chief executive and board of directors. The company said it hoped the new structure would allow it to be more nimble and unlock greater value for investors.