A year after inflation galvanized bets against the US stock market, it’s becoming Exhibit A for those wagering that this year’s rally will continue.

Since the consumer price index surged by a four-decade high of 9.1% in June 2022, it has pulled back steadily in the face of the Federal Reserve’s monetary policy onslaught. That’s expected to continue on Wednesday, when economists forecast that the Labor Department will report the index rose just 3.1% last month — the smallest annual increase since March 2021.

That slowdown has given support to the stock-market’s surge this year by justifying speculation that the Fed is nearly done, even if there are still a few more hikes to come. The bulls have strong precedent for their enthusiasm: Since the 1950s, inflation peaks have almost always been followed by double-digit equity gains, according to data compiled by the Leuthold Group.

“It appears the Fed is winning its fight against inflation,” said Adam Sarhan, founder of 50 Park Investments.

“I’m operating like we’re in the beginning of a new bull market until any significant weakness says otherwise,” he said. “There needs to be a reason to sell. As long as inflation isn’t a major threat and the Fed doesn’t change its stance on rates, this is a golden opportunity to buy stocks.”

The S&P 500 Index has gained more than 20% since it bottomed out in October, placing it up about 15% since the peak CPI data was released in July 2022. The tech-heavy Nasdaq 100 Index is up 40% from last year’s lows, fueled in part by enthusiasm for advances in artificial intelligence.

The key driver, though, has been the hope that easing inflation pressures will allow the Fed this year to wind up the monetary policy campaign that’s pushed its benchmark rate from near zero in early 2022 to its current range of 5%-5.25%.

With Fed policymakers heading into a silent period next week, traders are focused on this week’s CPI release for insight into the central bank’s likely path. After last week’s jobs report signaled a slowdown in a still-strong labor market, the figures will set the stage for stocks leading up to the central bank’s rate decision on July 26 and Chair Jerome Powell’s subsequent press conference.

Of course, there remain plenty of risks for the stock market, and traders this year have repeatedly pushed out the timing of when the Fed’s rate will peak as the economy held up better than expected. Many Wall Street strategists have also maintained a bearish outlook, expecting that equities will fall during the second half of the year as growth slows.

What’s more, stronger-than-expected wage growth for June will likely keep the Fed on track to raise interest rates this month, with traders pricing in strong odds that it will be followed by one more such increase this year. So any sign that inflation is still stubbornly elevated may put pressure on pricey corners of the stock market, particularly technology companies that have left the Nasdaq 100 trading around 29 times projected earnings.

“AI will be a very big thing for investors over the next decade, but you have to be careful in the short run,” cautioned Cheryl Smith, portfolio manager and economist at Trillium Asset Management, citing the risk of a recession.

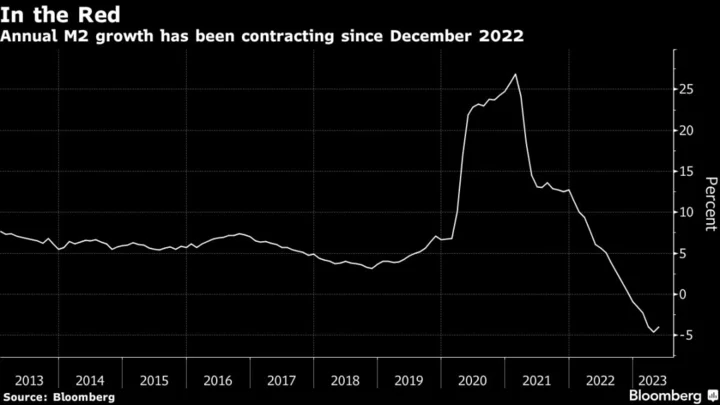

But strategists at Wells Fargo Securities say the Fed’s monetary policy tightening is expected to keep showing gains on the inflation front at least, if history is any guide. The strategists cite the strong correlation between changes in consumer prices and those in a commonly used measure of the money supply known as M2. That measure has been contracting, which they said will likely continue to slow inflation as it pulls demand out of the economy.

“More liquidity is associated with inflation growth and vice versa,” Chris Harvey, head of equity strategy at Wells Fargo, said by email. “M2 has been contracting for over a year and is still contracting, though at a decelerating rate. If the economy muddles along and inflation comes down, it’s supportive of higher equity prices.”