India’s economic activity continued to expand in May thanks to buoyant domestic demand, assuring policymakers that rates can be kept higher for longer though the biggest risk now is heat waves and below-normal rains.

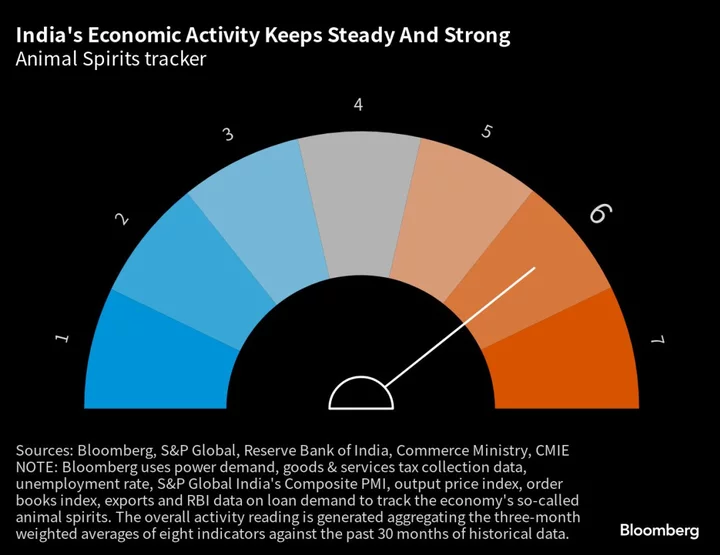

The needle on a dial measuring the so-called Animal Spirits stayed at six for a second month even as some indicators such as exports and tax collections showed signs of weakness. While four of the eight high-frequency indicators compiled by Bloomberg showed improvement, three worsened slightly and one was little changed.

Robust demand and moderating raw material costs are helping the South Asian nation grow faster than most major economies in the world. It’s giving room to the Reserve Bank of India to keep borrowing costs higher until inflation is firmly under control.

The central bank, which left its benchmark rate unchanged this month, expects the economy to grow 6.5% in the current financial year, but professional forecasters expect a slower rate of expansion on the uneven monsoon.

Here are more details from the animal spirits barometer, which uses a three-month weighted average to smooth out volatility in single-month readings:

Business Activity

Purchasing managers’ surveys showed manufacturing activity hit a 31-month high in May, “backed by record expansion in input stocks,” according to S&P Global Inc. Although services activity slowed from a near 13-year high in April, it was still faster than any other month and keeps the composite index at a high for a second straight month.

The data was a “compelling testament to prevailing demand resilience,” said Pollyanna De Lima, economics associate director at S&P Global Market Intelligence. But inflation remains a challenge and “long-waited cuts to interest rates — which could aid business strategies, budgeting and investment plans — appear more distant,” she said.

Exports

Outbound shipments continued to remain a drag on the economy, falling for a sixth month. Sluggish demand from buyers overseas dragged down exports by 10.3% in May, while imports fell 6.6%, taking the trade deficit to a five-month high. The slowdown reached India’s booming services sector too, with export growth slowing to 0.7% from 7.4% in April.

READ: Goldman’s Biggest Office Beyond New York Attests to India’s Rise

Moderating services export growth “could result in weaker urban consumption demand, due to slower information technology hiring, but the balance of payments impact is manageable,” Nomura Holdings Inc. economists Sonal Varma and Aurodeep Nandi said after the trade data was released last week.

Consumer Activity

The RBI’s decision to withdraw the 2,000-rupee notes from circulation gave further boost to liquidity in the banking system before the monetary authority started mopping up for better transmission of rates. Overall bank credit growth slowed to 15.42% from 15.90% a month ago, as companies borrowed less.

Goods and services tax collections fell from a record 1.87 trillion rupees ($22.6 billion) in April to 1.57 trillion rupees in May, rising 12% from a year ago. The mop-up at a three-month low indicated some moderation in demand amid rising inequality, as well as lower revenue growth for firms amid cooling inflation.

The demand was still robust in other pockets, with retail sales of vehicles jumping 10% in May, recovering from a fall of 1.4% fall in the previous month, according to data from the Federation of Automobile Dealers Associations.

Market Sentiment

Electricity consumption, a widely used proxy to measure demand in industrial and manufacturing sectors, jumped from April as temperatures soared. Peak demand in May rose to 204 gigawatt from 178 at the end of April.

India’s unemployment rate fell to a three-month low of 7.70%, from 8.50% in April, as people dropped out of the labor force. Surge in sales also helped companies expand their workforce.

--With assistance from Karthikeyan Sundaram and Adrija Chatterjee.