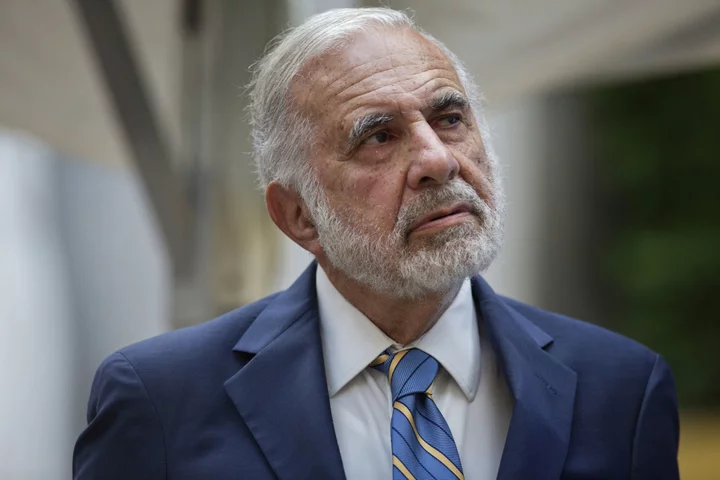

Investors wiped as much as $2.3 billion off the market value of Carl Icahn’s investment firm Wednesday after it disclosed a federal inquiry into its practices, adding to the pressure that a short seller attack has been putting on the stock since last week.

The US Attorney’s office for the Southern District of New York is seeking information on Icahn Enterprises LP’s corporate governance, securities offerings, dividends and due diligence, among other materials, according to a filing. Icahn Enterprises said it was cooperating with the request.

Separately, the firm hit back in detail for the first time against short-selling firm Hindenburg Research’s report, which claimed on May 2 that the company is overpriced, and said it found evidence of inflated valuations for some of its assets. Since then, Icahn Enterprise’s stock has lost about 36% of its value.

“We have Carl, the liquidity, the strategy and the know-how to fight back,” the firm said in a statement.

Icahn is no stranger to Wall Street battles but he’s the one usually directing the criticism as opposed to being on the receiving end, which is the spot Hindenburg has put him in.

Icahn Enterprises’ stock closed 15% lower at $32.22 at in New York, giving it a market value of $11.9 billion. Earlier, it had fallen as much as 21%.

In the filing Wednesday, the company said that the US attorney’s office has not made any claims or allegations against Icahn or his firm.

A representative for the US attorney’s office declined to comment.

“We believe that we maintain a strong compliance program and, while no assurances can be made and we are still evaluating the matter, we do not currently believe this inquiry will have a material impact on our business, financial condition, results of operations or cash flows,” the company said.

Federal prosecutors in Manhattan previously investigated another subject of a Hindenburg Research report, Nikola Corp. founder Trevor Milton. The electric-truckmaker went public through a blank-check vehicle in 2020, a deal that made Milton a billionaire overnight. Days later though, Bloomberg News reported that Milton had exaggerated the capability of the company’s debut truck. Hindenburg Research published a detailed report accusing Milton and Nikola of deceiving investors.

Milton resigned shortly after and was charged with fraud the following year. He was found guilty in October and is scheduled to be sentenced next month.

Blitzkrieg Research

Icahn Enterprises reported first quarter earnings Wednesday, with Chief Executive Officer David Willetts saying it stands behind its fundamentals. Icahn didn’t appear on the call.

Hindenburg said May 2 that Icahn Enterprises’ value is inflated by 75% or more, noting that it trades at a premium of more than 200% to its net asset value. Other closed-end holding companies including Dan Loeb’s Third Point and Bill Ackman’s Pershing Square trade at discounts to their NAV.

In a press release responding to Hindenburg Wednesday, Carl Icahn said that the company’s NAV use “standard industry valuation methods” and that it was assisted by third-party consultants.

Icahn said that that comparing Icahn to Loeb’s and Ackman’s closed-end funds is like “comparing apples to oranges” since Icahn said he doesn’t charge fees to investors.

“There is no comparison between our activist strategy and operating businesses and the closed-end funds managed by others,” the company said.

Icahn, in his usual brash style, also took some shots at the short seller. “Hindenburg Research, founded by Nathan Anderson, would be more aptly named Blitzkrieg Research given its tactics of wantonly destroying property and harming innocent civilians,” he said.

Anderson didn’t respond to a request for comment.

--With assistance from Swetha Gopinath.

(Updates stock prices starting in the sixth paragraph)