Chancellor of the Exchequer Jeremy Hunt will redouble the squeeze on Britain’s crumbling public services to pay for £21 billion ($26.2 billion) of tax cuts designed to boost growth and revive the Conservative Party’s electoral fortunes.

Government departments face a further £19 billion of cuts after the election, expected next year, on top of spending plans that the Resolution Foundation research group had already branded “implausible.” It’s austerity that compares with the measures put in place by Chancellor George Osborne in the last decade.

The Institute for Fiscal Studies said “there’s a material risk that those plans prove undeliverable.” Even the Office for Budget Responsibility, the government’s fiscal watchdog, said the program is severe enough that it’s “a significant risk to our forecast.”

Hunt outlined the cuts in his Autumn Statement as he unveiled a package of growth policies to pull the UK out of years of stagnation and draw a clear dividing line with the opposition Labour Party.

“Our choice is not big government — high spending and high tax — because we know that leads to less growth, not more,” Hunt said in an attempted dig at his Labour opponents. “Instead we reduce debt, cut taxes and reward work.”

Speaking on Sky News on Thursday, Hunt said the government will “show discipline” on public spending and acknowledged it will not rise “as fast as some people would like, but that is happening because I’m choosing to cut taxes, mainly for business.”

Hunt’s key growth policies were a a £10 billion a year reduction in national insurance contributions paid by 27 million workers, reducing the take by 2 points from 12%. A break for corporate investment will be made permanent, costing £11 billion, in a move that was widely applauded by business. Labour signaled it’s likely to keep both plans.

Despite saying the measures amounted to “the biggest package of tax cuts to be implemented since the 1980s,” the tax burden remained at a post-World War II high of 37.7% of GDP. That’s due to pre-existing policies, which will freeze income tax thresholds until 2028.

“The cuts are dwarfed by £45 billion of already announced threshold freezes,” Torsten Bell, chief executive of the Resolution Foundation, said. Had Hunt not cut taxes, the tax burden would have hit 38.4%, the OBR said.

For all Hunt’s talk of growth, it was not a thriving economy but inflation that came to his rescue. While Prime Minister Rishi Sunak has been trying to defeat inflation all year, rising prices boosted tax revenue to the Treasury, giving Hunt room for maneuver.

Trend growth, which determines living standards, was downgraded by a total of 2.4% between 2023 and 2027 but the cash size of the economy, which includes inflation effects, was upgraded by 5.5%. “Taxes aren’t being cut because inflation has fallen,” Bell said. “They’re being cut because inflation has been higher than expected.”

The result was £30 billion of headroom against his fiscal rule that debt must be falling as a share of GDP in the fifth year of the forecast. Hunt used all but £13 billion of it but half is expected to be used to scrap fuel duty in March, leaving him with the same £6.5 billion of fiscal space at the budget he had eight months ago.

Alongside full expensing and the NICs cuts, Hunt hopes to lift the economy by leveraging private capital through pension fund reforms, clearing obstacles in the planning system and ensuring work pays by getting tough on benefits while lifting the minimum wage.

The OBR judged the package will claw back 0.3% of lost growth by 2028. Full-expensing lifts business investment by £20 billion at the end of the forecast, it said, while the NICs cut and benefits reforms boost labor supply by 78,000.

The quest for stronger growth and low taxes unites both parties. Hunt’s plan to turbo-charge the economy and give households some of their money back is little different to his opposite number, Labour’s shadow chancellor Rachel Reeves.

She has attacked the 25 tax rises since Sunak became chancellor in 2021 and accused Hunt of “picking the pockets of working people.” She told reporters earlier this month: “It is because this is a government of low growth that it is a government of high taxes.”

Hunt left little doubt that the Autumn Statement teed the Conservatives up for an election in 2024, but he faces a difficult backdrop.

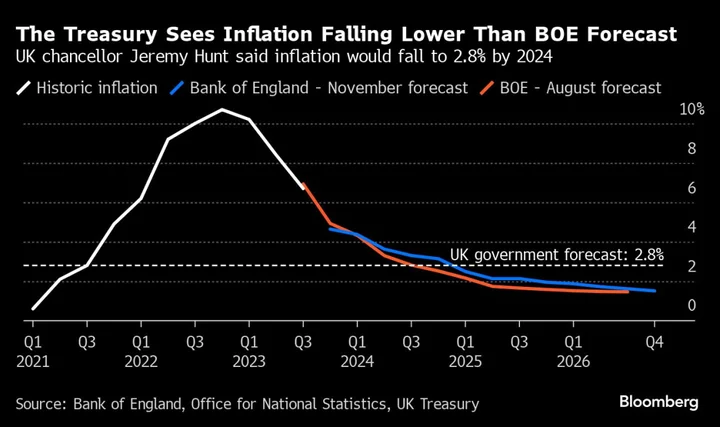

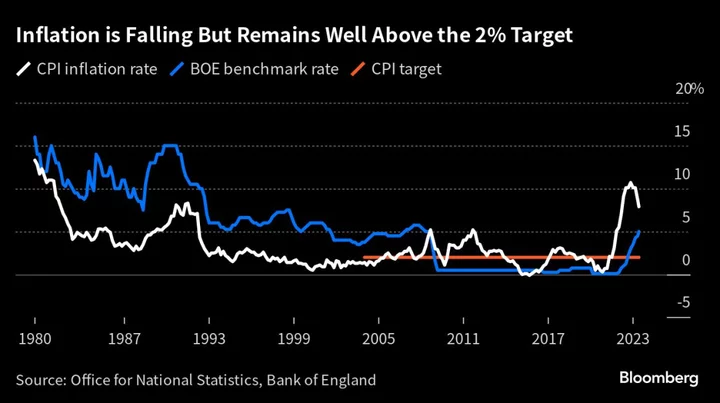

Inflation has more than halved, meeting Sunak’s target for the year, but remains the highest in the Group of Seven nations. The OBR warned consumer prices will be stickier than thought and not return to the Bank of England’s 2% target until early 2025.

Households are in the midst of the steepest fall in living standards since the 1950s, the OBR said. While the outlook has improved since March, real household disposable income is on track to have fallen 3.5% between 2020 and 2025.

And markets also raised concerns about the glut of gilts to pay for the £93 billion six-year stimulus. The yield on 30-year government bonds rose 10 basis points as traders adjusted to the bigger-than-expected debt issuance plans.

Even so, Hunt has some short-term giveaways for the election year, including £2.65 billion of business rates relief for retail and hospitality firms, £270 million for regional investment in 2024, and a one year freeze in alcohol duties.

For poorer households there was help, too. Benefits will rise 6.7% to provide “vital support for those on the very lowest incomes,” Hunt said. The state pension will increase 8.5% and the minimum wage is rising 10%.

The choice that Hunt mapped out was low-tax, private sector-led growth with the Tories or big-state interventionism with Labour and its £28 billion green investment plan.

Labour’s Reeves said households are paying the price of for 13 years of Tory rule. “Nothing that has been announced today will remotely compensate rising mortgages, rising taxes eating into wages, inflation high with prices still going up in the shops, public services on their knees, and too many families struggling to make ends meet,” she said in Parliament.

--With assistance from Andrew Atkinson and Greg Ritchie.

(Updates with Hunt comment in sixth paragraph.)