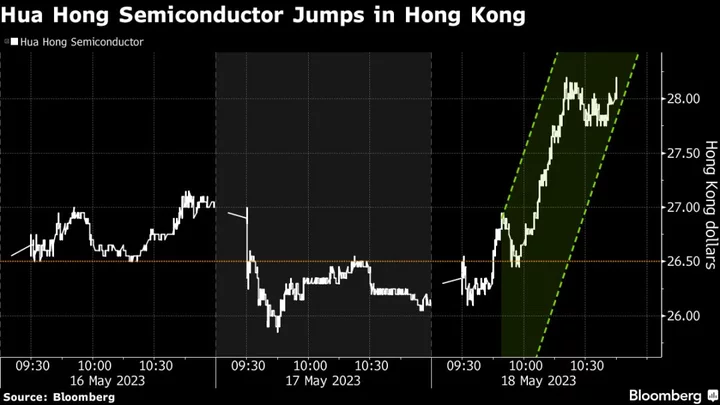

Hua Hong Semiconductor Ltd. has received a green light for its 18 billion yuan ($2.6 billion) second listing on Shanghai’s Star board, potentially the biggest in China this year. Its Hong Kong-listed shares jumped the most in five months.

The Shanghai stock exchange on Wednesday approved the share sale plans of the Hong Kong-listed firm, according to the bourse’s website. The company will still have to register its plans with the regulator and hasn’t set any timeline or provided other details of the potential offering.

Giving semiconductor technology companies access to public markets aligns with China’s plans to support the sector, countering a US-led campaign to block access to cutting-edge technologies. The US has blacklisted several of China’s most advanced companies and research institutes in diverse fields from chips and supercomputing to cloud and data mining.

Hua Hong’s share sale would also bolster the domestic capital market, which has seen a slowdown in fundraising amid economic concerns. Newly-listed companies have raised about $24 billion in China this year, slightly more than half of the $43 billion raised in the same period a year ago, according to data compiled by Bloomberg. At $2.6 billion, Hua Hong’s Shanghai listing would be the country’s biggest this year.

Shanghai-based Hua Hong manufactures semiconductors on 200mm wafers for specialty applications and provides products for sectors including consumer electronics, communications and computing. The company raised about HK$2.6 billion ($332 million) in an initial public offering in Hong Kong.

The shares jumped as much as 11% to HK$28.40, before paring the gain to 9.8% as of 11:04 a.m. local time. Guotai Junan Securities Co. and Haitong Securities Co. are arranging the Shanghai listing.

--With assistance from Filipe Pacheco.

(Updates with stock move in first and last paragraphs)