By Saqib Iqbal Ahmed

NEW YORK A relentless selloff in U.S. government bonds has brought Treasury yields to their highest level in more than a decade and a half, roiling everything from stocks to the real estate market.

The yield on the benchmark 10 year Treasury - which moves inversely to prices - hit 5% late Thursday, a level last seen in 2007. Expectations that the Federal Reserve will keep interest rates elevated and mounting U.S. fiscal concerns are among the fators driving the move.

Because the $25-trillion Treasury market is considered the bedrock of the global financial system, soaring yields on U.S. government bonds have had wide-ranging effects. The S&P 500 is down about 7% from its highs of the year, as the promise of guaranteed yields on U.S. government debt draws investors away from equities. Mortgage rates, meanwhile, stand at more than 20-year highs, weighing on real estate prices.

"Investors have to take a very hard look at risky assets," said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities in New York. "The longer we remain at higher interest rates, the more likely something is to break."

Fed Chairman Jerome Powell on Thursday said monetary policy does not feel "too tight," bolstering the case for those who believe interest rates are likely to stay elevated.

Powell also nodded to the "term premium" as a driver for yields. The term premium is the added compensation investors expect for owning longer term debt and is measured using financial models. Its rise was recently cited by one Fed president as a reason why the Fed may have less need to raise rates.

Here is a look at some of the ways rising yields have reverberated throughout markets.

Higher Treasury yields can curb investors' appetite for stocks and other risky assets by tightening financial conditions as they raise the cost of credit for companies and individuals.

Elon Musk warned that high interest rates could sap electric-vehicle demand, which knocked shares of the sector on Thursday. Tesla’s shares closed the day down 9.3%, as some analysts questioned whether the company can maintain the runaway growth that has for years set it apart from other automakers.

With investors gravitating to Treasuries, where some maturities currently offer far above 5% to investors holding the bonds to term, high-dividend paying stocks in sectors such as utilities and real estate have been among the worst hit.

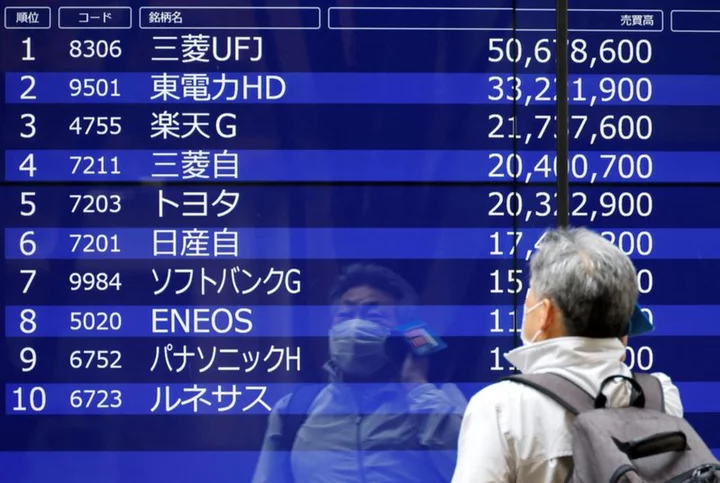

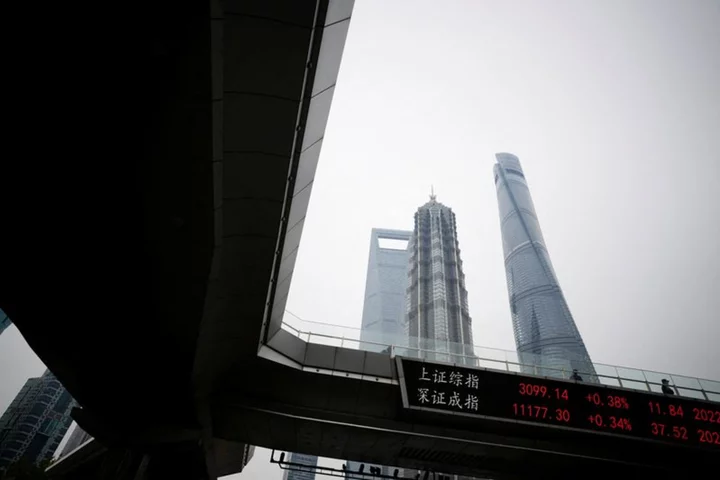

The U.S. dollar has advanced an average of about 6.4% against its G10 peers since the rise in Treasury yields accelerated in mid-July. The dollar index, which measures the buck’s strength against six major currencies, stands near an 11-month high. A stronger dollar helps tighten financial conditions and can hurt the balance sheets of U.S. exporters and multinationals. Globally, it complicates the efforts of other central banks to tamp down inflation by pushing down their currencies. For weeks, traders have been watching for a possible intervention by Japanese officials to combat a sustained depreciation in the yen, down 12.5% against the dollar this year.

"The correlation of the USD with rates has been positive and strong during the current policy tightening cycle," BofA Global Research strategist Athanasios Vamvakidis said in a note on Thursday.

The interest rate on the 30-year fixed-rate mortgage - the most popular U.S. home loan - has shot to the highest since 2000, hurting homebuilder confidence and pressuring mortgage applications. In an otherwise resilient economy featuring a strong job market and robust consumer spending, the housing market has stood out as the sector most afflicted by the Fed's aggressive actions to cool demand and undercut inflation.

U.S. existing home sales dropped to a 13-year low in September.

As Treasury yields surge, credit market spreads have widened with investors demanding a higher yield on riskier assets such as corporate bonds. Credit spreads blew out after a banking crisis this year, then they narrowed in subsequent months.

The rise in yields, however, has taken the ICE BofA High Yield Index near a four-month high, adding to funding costs for prospective borrowers.

Volatility in U.S. stocks and bonds has bubbled up in recent weeks as expectations have shifted for Fed policy. Anticipation of a surge in U.S. government deficit spending and debt issuance to cover those expenditures has also unnerved investors.

The MOVE index, measuring expected volatility in U.S. Treasuries, is near its highest in more than four months. Volatility in equities has also picked up, taking the Cboe Volatility Index to a five-month peak.

(Reporting by Saqib Iqbal Ahmed; Writing by Ira Iosebashvili)