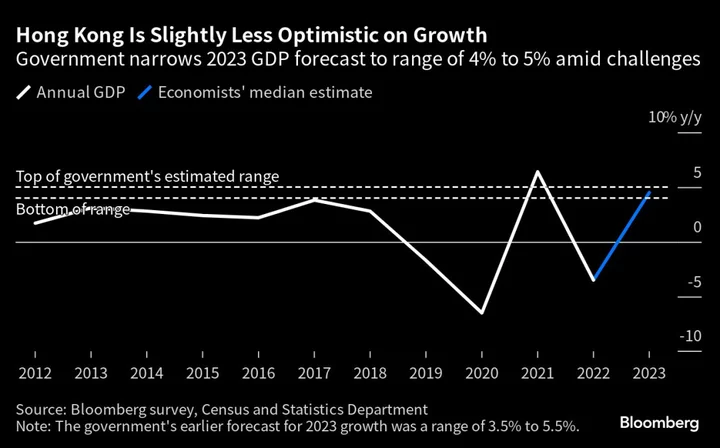

Hong Kong is slightly less optimistic about its outlook for economic growth this year as the post-pandemic activity boom runs out of steam and challenges from China and the rest of the world weigh on the financial hub.

Gross domestic product is expected to expand in a range of 4% to 5% in 2023, compared with a previous prediction of 3.5% to 5.5%, the Census and Statistics Department said Friday.

Authorities attributed the revision for the full year to a “difficult global economic environment” that will “continue to weigh on Hong Kong’s exports of goods,” according to a statement accompanying the data. The government also said inbound tourism and private consumption will “remain the major drivers” of growth.

An improving economy “should bode well for domestic demand, though tight financial conditions may impose constraints,” according to the statement.

“Tourism will still offer cyclical help, but the trimmed upper-bound growth expectation clearly shows the stronger headwinds Hong Kong will be facing in the coming months due to slower China economic momentum and the weak sentiment domestically,” said Gary Ng, a senior economist at Natixis.

GDP grew 1.5% in the April-to-June period from a year earlier, according to final second-quarter figures released by the government on Friday. On a quarter-on-quarter basis, GDP contracted 1.3%.

Advanced versions of those figures — which were in line with the final ones — published late last month took analysts by surprise. Economists expected GDP to increase 3.5% as the city bounced back in 2023. Hong Kong spent years mired in recession, contracting in three of the past four years as the city’s tough virus controls restricted border flows and curbed local activity.

“Tourism will still offer cyclical help, but the trimmed upper-bound growth expectation clearly shows the stronger headwinds Hong Kong will be facing in the coming months due to slower China economic momentum and the weak sentiment domestically.

The economy expanded 2.9% in the first quarter as it rode the reopening recovery. But it’s run into challenges as mainland China’s economic rebound sputters and global demand cools, weighing on the city’s exports.

Financial Secretary Paul Chan has also flagged more muted spending habits among residents. They are in some cases taking their money to neighboring Shenzhen, which he said has emerged as a popular tourist and shopping destination.

The city’s tourism industry has also struggled, with visitor arrivals down 2.8% in June from the month before, according to the Hong Kong Tourism Board. The number of tourists from mainland China was down 5.7%.

After the disappointment from the initial second-quarter data, several economists cut their GDP forecasts for the year, and now see the economy expanding around 4%.

(Updates with comments in the fifth paragraph.)