With the Securities and Exchange Commission opting against appealing a ruling that paves the way for Grayscale Investments LLC to convert its Bitcoin trust into an exchange-traded fund, analysts are now trying to gauge how the process may unfold from here.

The crypto asset-manager earlier this year scored a legal victory in federal court in its bid to turn its Grayscale Bitcoin Trust (ticker GBTC) into the first US ETF that would invest directly in the largest digital coin. The SEC faced a Friday deadline to appeal the ruling. The agency is not planning any other appeals in the case, according to a person familiar with the matter, who asked not to be identified discussing the ongoing matter.

What’s likely to occur is that dialog between Grayscale and the SEC is going to open up, according to James Seyffart, an analyst at Bloomberg Intelligence. “We’ll get more information next week and then we’ll know what happens next,” he said. Seyffart added that the regulator has the option to file an appeal with the Supreme Court, though he views that as highly unlikely to happen.

The SEC didn’t respond to a request for comment on the agency’s plans for spot Bitcoin ETFs.

Grayscale has argued that a conversion of GBTC into an ETF could unlock billions in value for its holders. Its court win was seen as monumental for the industry because it sparked excitement within the digital-assets community that a Bitcoin ETF could, after a decade-long battle, finally be had in the US. The SEC had been hesitant in the past to give a green-light. But there are currently a slew of companies, including BlackRock Inc. and Invesco, among others, trying to get such a product launched.

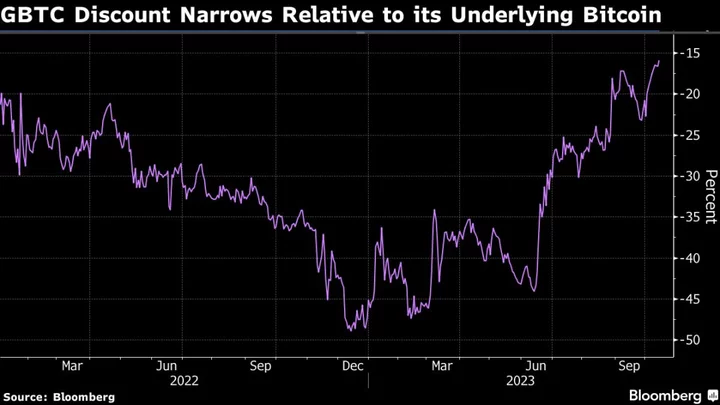

Immediately following the Grayscale ruling in August, shares of GBTC rallied more than did Bitcoin itself, with the trust’s discount to its underlying holdings narrowing significantly. The gap earlier this year stood above 45% but has constricted to below 20%, data compiled by Bloomberg show. A slew of high-profile investors including Cathie Wood and Boaz Weinstein appear to have been well positioned for the narrowing, having scooped up GBTC shares at the height of its recent distress.

Read more: Cathie Wood, Boaz Weinstein Among Winners From Bitcoin Fund Bet

Progress on the Grayscale conversion-front brings further clarity to the ETF-approval process, which has remained opaque to industry watchers as many were unsure about how the SEC would handle the asset-manager’s proceedings, as well as the numerous other outstanding applications. A key remaining question is whether the regulator will allow multiple Bitcoin ETFs to launch all at once.

Analysts at Bloomberg Intelligence argue that a recent update to an application from ARK and 21Shares signals a “constructive conversation” with regulators that typically only happens when an ETF is on its way to approval. They say there’s a 90% chance of SEC approval by around Jan. 10.

--With assistance from Austin Weinstein.