White House takes steps to avoid damaging auto strike

The White House is closely monitoring the upcoming labor talks in the US auto industry, negotiations that could put it at odds with the traditional support of a major union. So President Joe Biden is tapping a trusted adviser, Gene Sperling, to serve as the administration's point person in upcoming labor negotiations between the United Auto Workers union and the nation's three unionized automakers.

2023-07-06 04:55

Cognito Therapeutics Appoints Greg Weaver as Chief Financial Officer

CAMBRIDGE, Mass.--(BUSINESS WIRE)--Oct 17, 2023--

2023-10-17 20:23

Powell in Capitol Hill Spotlight After Fed Pauses

Jerome Powell will be in the Capitol Hill spotlight a week after the Federal Reserve paused its most

2023-06-18 04:49

Nigeria's GDP growth slows to 2.5% y/y in Q2 as reforms get under way

By Chijioke Ohuocha ABUJA Nigeria's annual economic growth rate slowed to 2.51% in the second quarter, data showed

2023-08-25 21:53

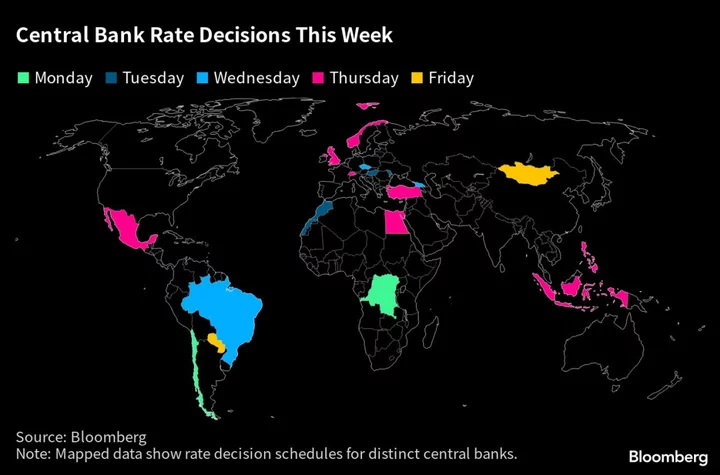

Brazil central bank cuts rates by 50 bps, signals further reductions ahead

By Marcela Ayres BRASILIA Brazil's central bank cut its benchmark interest rate by 50 basis points on Wednesday

2023-11-02 06:27

Introducing Cognite AI, the Generative AI Accelerator for Industrial Data and Value Realization

AUSTIN, Texas & OSLO, Norway--(BUSINESS WIRE)--Jun 15, 2023--

2023-06-15 15:19

Argentine shoppers face daily race for deals as inflation soars above 100%

By Miguel Lo Bianco and Claudia Martini BUENOS AIRES Argentines, up against painful annual inflation at 113% and

2023-09-13 19:15

FTX Adds a Complex Chapter to the Financial-Fraud History Books

When former crypto titan Sam Bankman-Fried was convicted of seven counts of fraud and conspiracy on Nov. 2,

2023-11-12 22:50

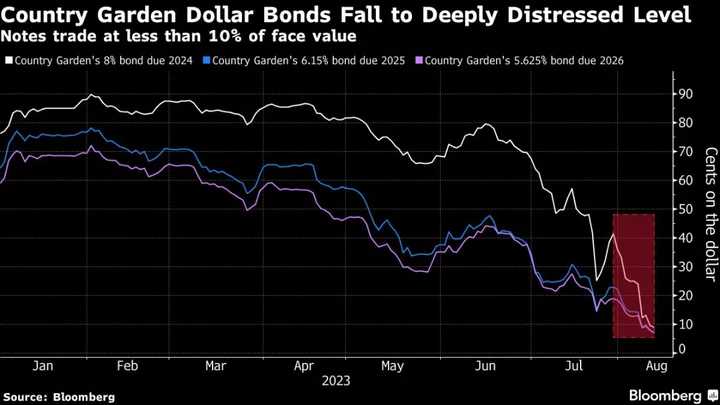

Country Garden Aims to Extend Maturing Bond in First Amid Crisis

Country Garden Holdings Co. is seeking to extend a maturing bond for the first time ever and halted

2023-08-14 18:21

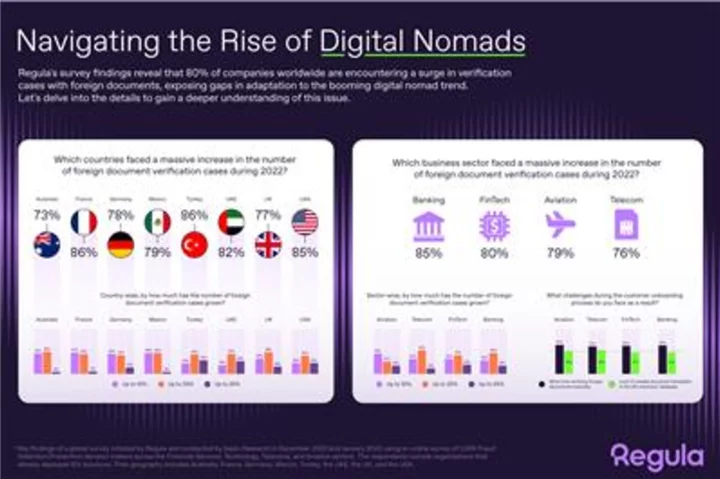

Global Survey: Financial Organizations Challenged by the Growing Community of Digital Nomads

RESTON, Va.--(BUSINESS WIRE)--May 23, 2023--

2023-05-23 15:20

Wall Street is strangely calm about the debt ceiling. That could all change this month

Dire warnings about the economic chaos and catastrophe that will ensue if the US debt ceiling isn't lifted soon abound. Still, markets remain rather sanguine about the Washington drama.

2023-05-10 19:56

Analysis-Oil cut extension raises risk of Saudi economic contraction this year

By Yousef Saba and Rachna Uppal DUBAI Saudi Arabia faces the risk of an economic contraction this year

2023-09-08 17:16

You Might Like...

United Natural Foods, Inc. Concludes Successful 2023 Conventional Winter Show

Global Goods Trade Rebounds on Demand for Cars, WTO Says

Asian markets mostly gain ahead of key rate decisions

Dollar soft as investors digest 'higher for longer' path

Ford recalls over 870,000 F-150 trucks in US - NHTSA

Nidec Completes Acquisition of Automatic Feed Company and Related 2 Companies, US-based Press Machine Equipment Manufacturers

U.S. SEC to dismiss roughly 40 enforcement cases after internal data mishap

Recession? Corporate America’s Earnings Say It’s Already Arrived