Technip Energies Launches Canopy by T.EN™, Making Carbon Capture Accessible for Every Emitter

PARIS--(BUSINESS WIRE)--Jun 20, 2023--

2023-06-20 13:19

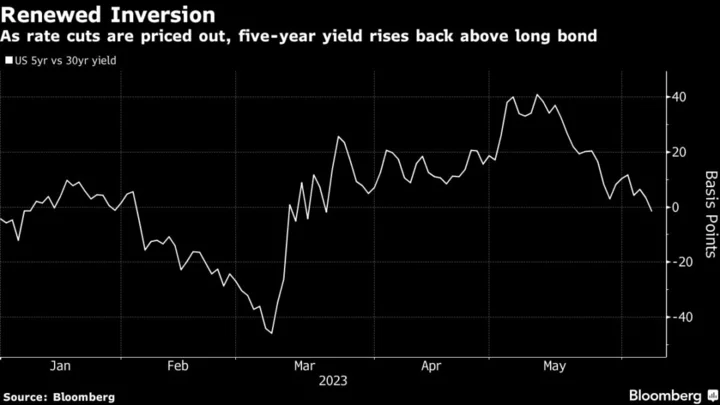

Traders Are Leaning Toward Fed Hike by July as Bond Yields Climb

The Treasury market briefly restored the full pricing of Federal Reserve tightening by July, which would be the

2023-06-08 03:51

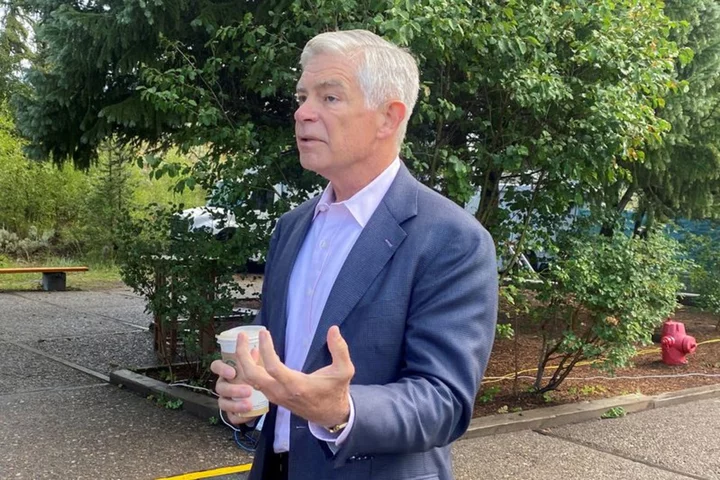

Acting US Labor chief urging West Coast ports contract agreement

By David Shepardson WASHINGTON (Reuters) -Acting U.S. Labor Secretary Julie Su is in California to meet with West Coast ports

2023-06-14 00:54

Embraer to meet 2023 delivery outlook, sees similar growth next year -CEO

By Gabriel Araujo SAO PAULO Brazilian planemaker Embraer is confident it will meet its outlook for aircraft deliveries

2023-10-11 22:47

Stock market today: Asian markets are mostly lower as oil prices push higher

Shares are mostly lower in Asia after a decline on Wall Street as traders returned from a long holiday weekend

2023-09-06 13:29

Korean Prosecutors Seek Crypto Millions Tied to Do Kwon and TerraUSD

Fallen crypto impresario Do Kwon has funneled tens of millions of dollars out of an entity linked to

2023-06-08 13:22

Exxon Among 50 Oil Producers in Controversial Climate Pact at COP28

Sign up for the Green Daily newsletter for comprehensive coverage of the climate summit right in your inbox.

2023-12-02 20:25

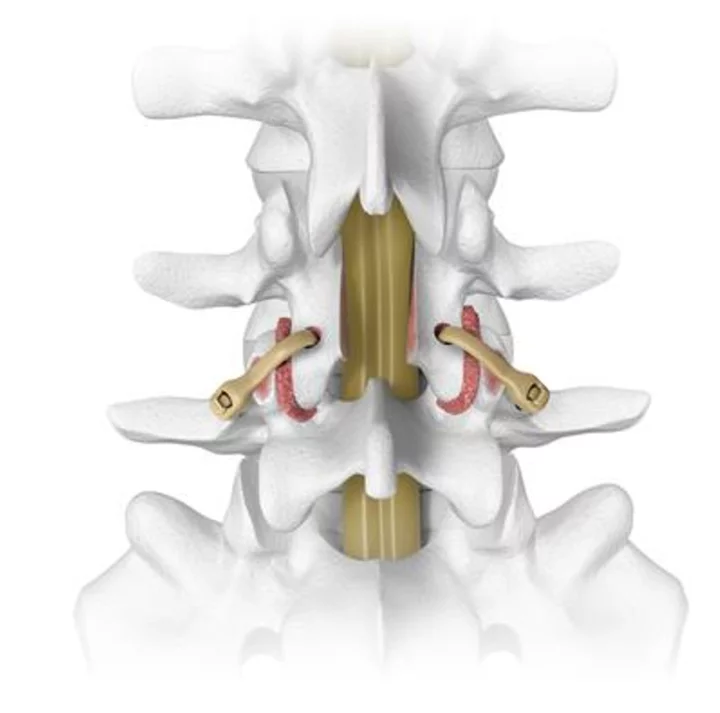

Spinal Elements® to Feature the Karma®, An Aging Spine, Metal-Free Fixation Solution, at Upcoming 38th Annual Meeting of the North American Spine Society

CARLSBAD, Calif.--(BUSINESS WIRE)--Oct 13, 2023--

2023-10-13 20:45

Fed's Harker tells CNBC he expects no more rate cuts this year

By Michael S. Derby NEW YORK Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday he doubts

2023-08-24 22:57

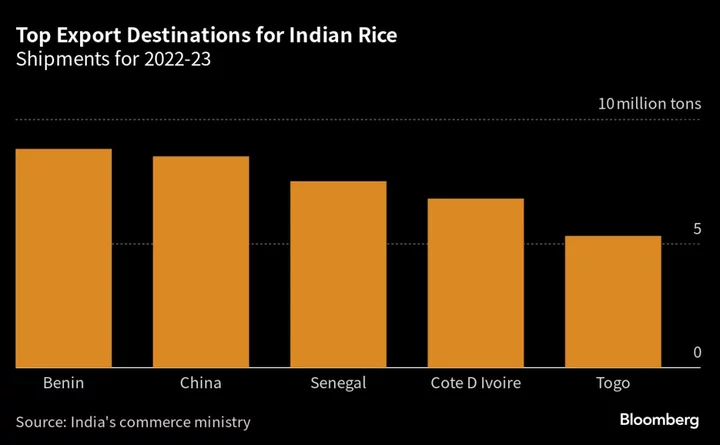

India Exempts Some Nations From Rice Curbs for Food Security

India has permitted some rice shipments to Mauritius, Bhutan and Singapore for food security purposes after the South

2023-08-31 13:56

National Bank of Coxsackie Opens Loan Production and Administrative Office in Latham, New York

LATHAM, N.Y.--(BUSINESS WIRE)--Aug 14, 2023--

2023-08-14 21:50

US carriers accelerate to bigger planes to overcome operating constraints

By Rajesh Kumar Singh CHICAGO United Airlines' plan to navigate the operating constraints dogging U.S. carriers is simple

2023-10-05 18:21

You Might Like...

Biden and Sunak Begin Talks on Ukraine Before NATO Summit

Workers in Disney World district criticize DeSantis appointees' decision to eliminate free passes

Trading platform Tradeweb in talks about US default contingency plans

Taiwan Political Upstart Threatens to Eclipse KMT as No. 2 Party

Philippines posts budget deficit of $4.42 billion in September

BlackRock Pushes Employees Back to Office Four Days a Week

UBS says $100 million blended finance initiative receives new backers

Everton agree takeover deal with American investment firm 777 Partners