X Corp sues anti-hate campaigners over Twitter research

The firm behind X, as Twitter is now known, is suing the Center for Countering Digital Hate

2023-08-02 07:16

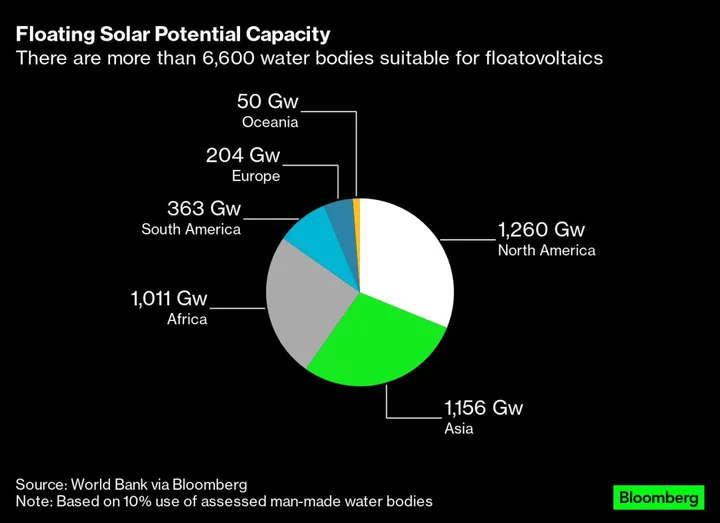

Floating Solar Panels Turn Old Industrial Sites Into Green Energy Goldmines

Putting solar panels on water to generate power sounded like a dangerous gimmick to Benedikt Ortmann when he

2023-08-03 12:29

Marriott projects upbeat revenue per room growth as travel demand stays strong

Marriott International on Wednesday forecast two-year annualized global revenue per available room (RevPAR) growth of 3% to 6%

2023-09-27 19:50

United Airlines buying land in Denver as it pursue growth strategy

By David Shepardson and Rajesh Kumar Singh United Airlines on Friday said it is spending $33 million to

2023-08-04 22:30

Backlash to data centers prompts political upset in northern Virginia

The tech industry’s drive to dot the Virginia landscape with data centers may have hit a snag this week in Prince William County

2023-06-23 03:22

Ex-chemical safety agency chief misused $90K on trips, renovations and other expenses, watchdog says

The former head of a federal agency that investigates chemical accidents improperly spent more than $90,000 during her tenure, including unauthorized trips to and from her California home, remodeling her Washington office and outside media training for herself, according to a new report by a federal watchdog

2023-06-30 05:49

Swiss Inflation Holds at 1.7%, Boosting Case for SNB Rate Pause

Swiss inflation stalled in October, delaying an anticipated rebound and strengthening the case for Swiss National Bank officials

2023-11-02 16:19

UK mortgage rates surge to 15-year high after surpassing 'mini-budget' peak

LONDON (Reuters) -A key British mortgage rate hit a 15-year high on Tuesday when it rose above the levels reached

2023-07-11 16:58

Nigeria fuel subsidy: Tinubu's plan to scrap measure sparks rush to stock up

People are hoping to stockpile petrol over fears of a major price increase amid high inflation.

2023-05-30 18:57

Brazil's antitrust watchdog approves L'Oreal deal to buy Aesop

SAO PAULO Brazil's antitrust regulator Cade on Wednesday recommended the approval of the sale of Natura & Co's

2023-05-18 01:46

Kansas farmers abandon wheat fields after extreme drought

By Tom Polansek WICHITA, Kansas Farmers in Kansas, the biggest U.S. producer of wheat used to make bread,

2023-05-23 00:51

South Korea-Japan Deal Helps Counter Pyongyang, Adviser Says

A deal between South Korea and Japan to remedy a long-running impasse can help work with their US

2023-05-11 15:56

You Might Like...

Bundesbank Chief Calls on Berlin to Create Budget Clarity Soon

Biden and McCarthy are projecting optimism, but there's still no debt limit deal

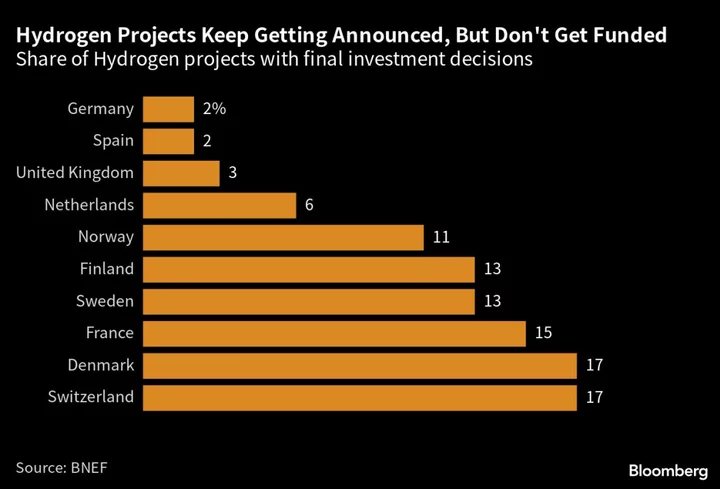

Hydrogen Hype Is Raging But Can’t Lure Investment to Europe

Stalled contract jeopardizes relations between new Disney governing body, firefighters

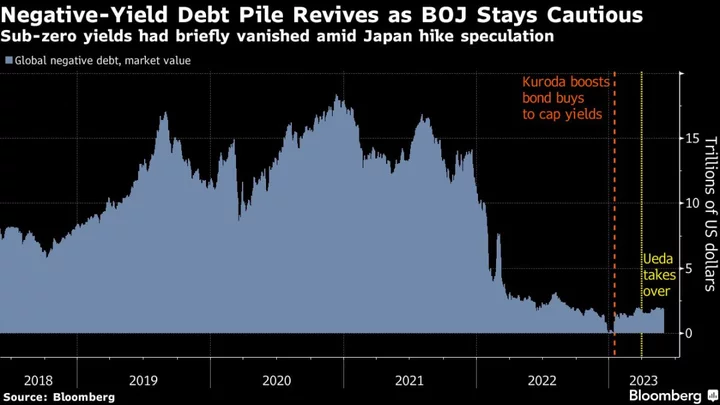

Negative-Yielding Debt Returns to Almost $2 Trillion on BOJ

Cinemark Launches Online Merchandise Shop in Latest Example of Customer-Centric Enhancements

Asian markets struggle as traders unmoved by US inflation data

US debt ceiling deal strands $16 billion of defense side-projects