Franklin Templeton to Buy Putnam as Desmarais Family Exits

Franklin Resources Inc. is buying Putnam Investments in a deal that unites two established asset management firms and

2023-06-01 04:16

Asian shares drop sharply as US price data revives rate hike jitters

By Ankur Banerjee SINGAPORE Asian shares slid on Friday while the dollar was firm after U.S. consumer prices

2023-10-13 11:23

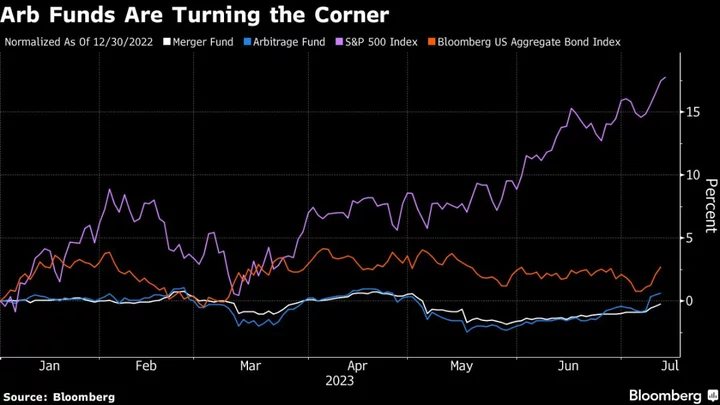

Merger-Arbitrage Funds See Tide Turning After FTC’s Microsoft-Activision Loss

Merger-arbitrage investors say the tide is turning in their favor after the Biden administration’s antitrust push suffered a

2023-07-15 04:19

Analysis-Strikes knock another leg out from under Australia’s LNG throne

By Emily Chow and Yuka Obayashi SINGAPORE/TOKYO Long before labour unrest at liquefied natural gas (LNG) plants threatened

2023-09-15 12:16

Apple Watch models face US import ban in patent clash

Medical technology company Masimo Corp. on Thursday said a US trade commission has recommended banning imports of Apple Watch models that infringe its light technology...

2023-10-27 11:22

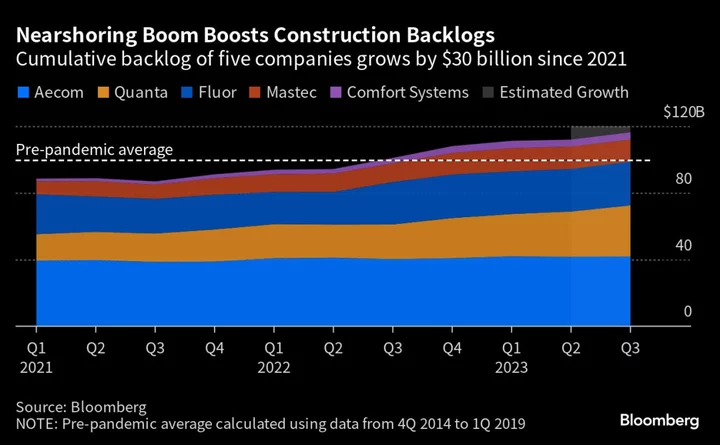

‘Made in USA’ Revival Sparks Building Boom, 506% Rally in Value

When Sterling Infrastructure Inc. Chief Executive Officer Joe Cutillo first started telling Wall Street that factories would return

2023-10-07 22:53

Mexican magnate's firm says it's too poor to pay US bondholders the tens of millions owed

The company run by Mexican TV, retail and banking magnate Ricardo Salinas Pliego says it has failed to reach agreement with bondholders in the United States who are owed tens of millions of dollars in past-due payments

2023-11-15 10:16

Dutch Lenders Slide as Parliament Approves Bank Tax Increase

The Dutch parliament’s lower house has approved a proposal to raise taxes on banks and add a levy

2023-09-22 17:52

Australia raises minimum wage by 5.75% as living costs surge

SYDNEY Australia's independent wage-setting body said on Friday it would raise the minimum wage by 5.75% from July

2023-06-02 08:54

German government forecasts that the country's economy will shrink by 0.4% this year

Germany's government says it expects the country’s economy to shrink by 0.4% this year

2023-10-11 20:49

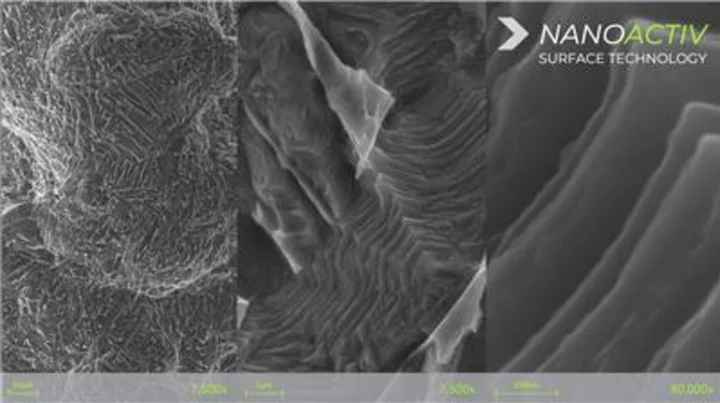

Xēnix Medical neoWave™ Interbody Systems Receive FDA Clearance for NANOACTIV™ Nanotechnology Surface

ORLANDO, Fla.--(BUSINESS WIRE)--Oct 10, 2023--

2023-10-10 21:22

bioAffinity Technologies Teams with American Cancer Society to Raise Funds for Lung Cancer Screening

SAN ANTONIO, Texas--(BUSINESS WIRE)--Nov 15, 2023--

2023-11-15 21:29

You Might Like...

ExxonMobil buying shale rival Pioneer in $60 billion deal

Old criminal records in New York would be automatically sealed under bill passed by lawmakers

Citigroup Says Rupee Is Set to Rebound From Near Record Low

Greece country profile

ECB’s Wunsch Says ‘Bit More’ Probably Needed on Rate Hikes

Prepare to flick off your incandescent bulbs for good under new US rules that kicked in this week

Nevada fight over leaky irrigation canal and groundwater more complicated than appears on surface

Sri Lanka reduces interest rates for 1st time since bankruptcy as economy shows signs of rebounding