In Iran, a restorer brings back to life famed Cadillac Sevilles once assembled in the country

A restorer in Iran is bringing back the Cadillac Sevilles once assembled in the country

2023-06-24 14:24

NTSB Calls for More Safety Technology After Spate of Near-Collisions on Airport Runways

Aviation safety technology that helps prevent runway near-collisions should be deployed at more US airports, the government’s top

2023-05-24 02:27

Ukraine Estimates Russia Has 420,000 Troops in Occupied Regions

Russia has more than 420,000 troops stationed in the areas of Ukraine it occupies, including Crimea, as it

2023-09-10 04:25

Billionaire Infosys Chair Gives Alma Mater $38.5 Million for AI

Billionaire Infosys Ltd. co-founder Nandan Nilekani will donate $38.5 million to his alma mater Indian Institute of Technology

2023-06-20 14:28

Montana TikTok ban unrealistic and misguided: experts

A total ban of TikTok in the US state of Montana is set up to face an epic battle in the courts, but many experts wonder whether...

2023-05-19 05:46

Tesla says its Texas factory hits output of 5,000 Model Ys per week

BERKELEY, California Tesla said on Tuesday that its Texas factory achieved production of 5,000 Model Y vehicles per

2023-05-10 07:17

Save $15 when you spend $50+ on home essentials from Amazon — no Prime membership required

SAVE $15: For a limited time, you can save $15 when you spend at least

2023-07-14 02:27

WTO launching global carbon price task force - Okonjo-Iweala

LONDON The World Trade Organization is launching a task force to create a methodology to determine global carbon

2023-10-18 00:24

KLM, major airlines appeal against Schiphol flight curbs

PARIS KLM, Delta, United and scores of carriers have filed an appeal at the Dutch Supreme Court to

2023-07-25 22:52

DAMAC International Submits Revised Sanitation and Service Bay Access Plans for 8777 Collins Avenue Based on New Town Guidelines

MIAMI--(BUSINESS WIRE)--Sep 26, 2023--

2023-09-27 00:48

Paytm Founder Sharma to Buy 10.3% Stake From Ant Affiliate

Paytm founder Vijay Shekhar Sharma will buy a 10.3% stake from an affiliate of China’s Ant Group Co.,

2023-08-07 11:49

Meloni and Scholz Deepen Ties, Leaving France Behind

Italian Prime Minister Giorgia Meloni and German Chancellor Olaf Scholz are spearheading a series of closer business dealings

2023-11-23 21:20

You Might Like...

Marketmind: Teed up for a bullish start to the week

Poland's political parties reveal campaign programs before the Oct 15 general election

'RHONY Reboot': Who is Jessel Taank's husband? How a dinner turned a five-year friendship for Bravo star into a decade-long marriage

Namibia’s Oil Firm Strikes Deal With Gunvor After Record Loss

Column-Funds' short dollar position smallest in three months: McGeever

Fitch upgrades Pakistan's sovereign rating to CCC after IMF deal

Brigade, Sculptor Among Now-Bankrupt WeWork’s Biggest Creditors

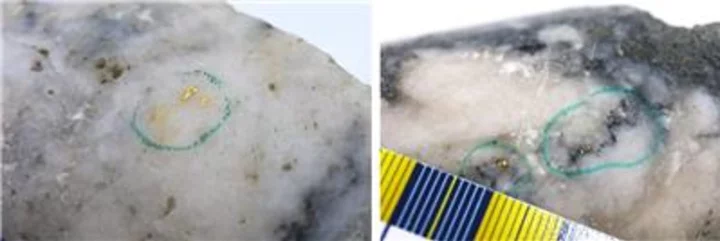

New Found Intercepts 92 g/t Au Over 2m at Monte Carlo