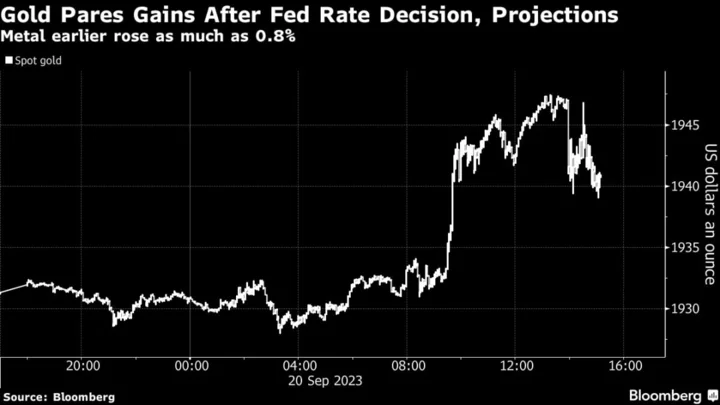

Gold pared gains after the Federal Reserve left its benchmark interest rate unchanged while signaling borrowing costs will likely stay higher for longer after one more hike this year.

The US central bank’s policy-setting Federal Open Market Committee, in a post-meeting statement published Wednesday in Washington, repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.”

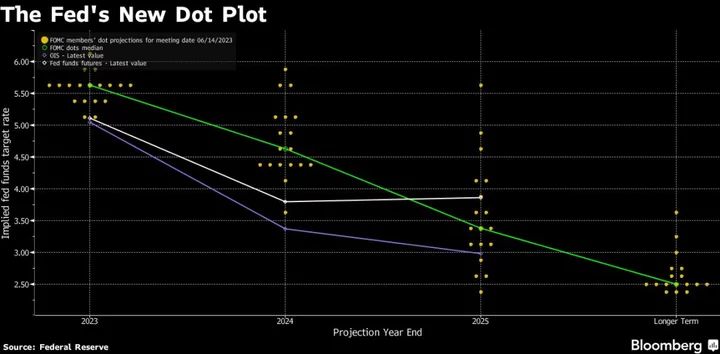

The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while updated quarterly projections showed 12 of 19 officials favored another rate hike in 2023, underscoring a desire to ensure inflation continues to decelerate.

Fed officials also see less easing next year, according to the new projections, reflecting renewed strength in the economy and labor market.

The rate decision and projections are “very hawkish,” said Ed Moya, senior market analyst at Oanda. “The dot plots are scaring gold investors as the Fed might not only keep on hiking, but rate cut bets for next year got slashed in half.”

Still, bullion held ground in the face of surging bond yields, with Treasury two-year yields climbing to the highest level since 2006. Higher interest rates tend to curb investor demand for non-yielding assets like commodities. Several other developed-market central banks will report this week, including the Bank of England, which may impact metals prices.

Fed Chairman Jerome Powell said he would not call a so-called “soft landing” for the US economy his baseline expectation. “I would not do that,” Powell told reporters Wednesday in response to a question during a press conference following the central bank’s two-day policy meeting.

“Ultimately, this may be decided by factors that are outside our control by the end of the day. But I do think it’s possible,” Powell said. “I also think this is why we are in a position to move carefully.”

Spot gold rose 0.3% to $1,936.47 an ounce as of 3:37 p.m. in New York after earlier advancing as much as 0.8%. Copper futures advanced 0.6% to settle at $8,345.50 a metric ton on the London Metal Exchange.