China’s sportswear stocks have been in a funk amid the nation’s sluggish consumption recovery. Analysts say earnings results of Anta Sports Products Ltd., one of the industry leaders on the mainland, may do little to lure back investors.

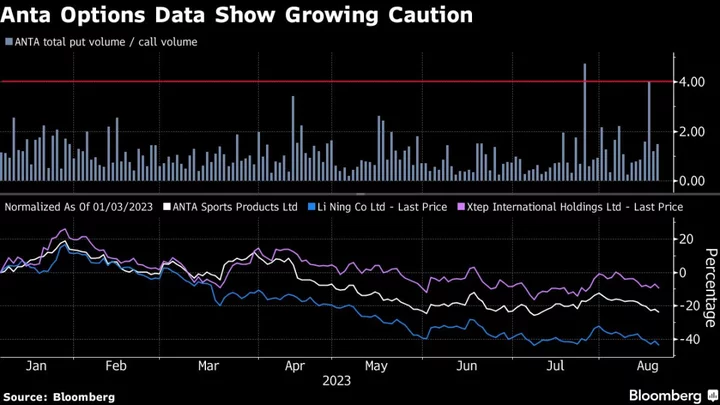

Bearish options activity and deep price target cuts from analysts signal growing caution ahead of Anta’s results Tuesday. Tepid consumer demand and competition from Nike Inc. and Adidas AG have also weighed on the sports apparel maker and its domestic peers. The company’s shares have dropped about 37% from a January high, while Li Ning Co. has more than halved since then. Meanwhile, Hong Kong’s benchmark has declined around 22%.

Investors “remain super skeptical” about the pace of China’s consumer rebound, said Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management. Although product discounts are becoming less prevalent, they’re still “an overhang in the short term.”

In the options market, Anta’s put-to-call volume ratio surged to over four times — the second highest reading for the year — on Wednesday, a sign of increasing bearishness. Additionally, Wednesday’s put volume was 3.2 times the average volume for the month so far, while the call volume was close to the average.

Anta’s average price target also fell 13% over the past three months, while Li Ning’s was slashed by 20% during the period, Bloomberg-compiled data show.

The pessimistic signs come as China’s latest official data show the country’s consumer recovery further lost momentum in July. Sports items and clothing sales each rose less than 3% on year after gains of at least 6% in June.

Read: Chinese Cut Back on Cosmetics, Still Spend at Restaurants

They also follow weak results from domestic rivals and growing sales for foreign competitors. Beijing-based Li Ning reported first-half earnings that missed expectations amid increased discounts. In contrast, Adidas said its greater China revenue jumped in the second quarter. Nike also delivered a better-than-anticipated performance in China for the quarter ended May.

“Foreign brands, particularly Nike, have been gaining market share from domestic leaders in certain price segments,” Sanford C Bernstein analysts including Melinda Hu wrote in a report Friday. As China reopens and consumers move past the Xinjiang cotton controversy, foreign sportswear brands have intensified investments to regain their foothold, she added.

Still, Anta is in a better position than Li Ning to withstand competition from Nike and Adidas given its international brands, according to Catherine Lim, a Bloomberg Intelligence analyst. Anta owns several labels including Fila and Descente.

The company may report a 14% rise in first-half revenue and a boosted dividend payout on Tuesday, Bloomberg data shows. Investors will closely assess management’s commentary on revenue trends after its second-quarter retail sales signaled weakness ahead. Peer Xtep International Holdings Ltd. delivers earnings on Wednesday.

--With assistance from Akshay Chinchalkar.