The price of gasoline is starting to surge everywhere, an inflationary omen for central banks and governments the world over.

Futures just soared to a nine-month high in New York, sending shock waves through to the pump, while prices have also been rising in Asia. Markets for the motor fuel have tightened worldwide due to a combination of unexpected refinery outages plus lower-than-normal stockpiles in key storage hubs such as the US Gulf Coast and Singapore for this time of the year.

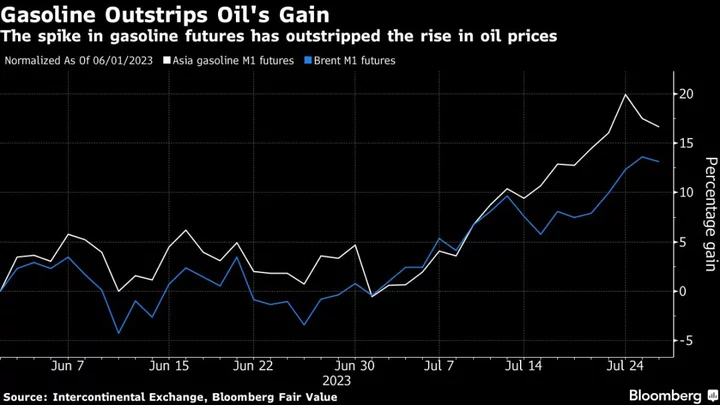

In global energy markets, it’s telling that while crude oil futures are little changed year-to-date, US gasoline contracts have rallied by more than 20%. The resurgence in gasoline potentially poses a headache for central banks including the US Federal Reserve as policymakers grapple with the problem of how much more monetary tightening, if any, is needed to bring inflation to heel.

Gasoline prices are often a topic of contention as those costs can be an essential daily expense for many, alongside food and rent. Energy prices are one of the many factors that have contributed to surging inflation globally. In the US, reining in prices at the pump will also be a crucial issue for President Joe Biden with the next election just over a year away, especially after he ordered the sale of a huge chunk of the nation’s strategic petroleum reserve last summer.

“Higher energy costs may push up consumer prices and lead to renewed goods inflation — a sector where price increases have slowed,” said Andrew Hollenhorst, chief US economist at Citigroup Inc.

For perspective, a one-cent rise in a gallon of gasoline in the US takes away about $1.15 billion annualized spending power, according to Brett Ryan, senior economist at Deutsche Bank AG. That means the $1.30 a gallon drop in the second quarter saved consumers $150 billion, and that’s money they could spend on other goods and services. Now, this tailwind could turn into a headwind and drag on spending should prices continue to rise materially, Ryan said.

Global Strength

Low inventories and high demand across key regions are driving prices higher around the world. In Europe, gasoline prices are rising faster than crude, although this trend has yet to fully translate to higher costs at the pump. Meanwhile, conditions in the Singapore market, a key Asian hub, have also firmed on lower-than-expected Chinese exports. In many emerging markets, that translates into a heavier burden for governments given many have fuel subsidies in place to buffer costs for poorer citizens.

Global gasoline supply has failed to recover significantly from historically low levels despite additions of refining capacity in the Middle East and China. Even the US had the biggest expansion in more than a decade, and that’s before another refinery slated to shut by year-end got an unexpected extension.

These expansions haven’t been enough to offset a string of unplanned outages including Exxon Mobil Corp.’s Baton Rouge unit in the US, Shell Plc’s Pernis site in Rotterdam and ENEOS Holdings Inc.’s’ Mizushima facility in Japan. These disruptions tightened supplies at a time when inventories are still low.

Refining systems across the world are more susceptible to outages after running hard for years, according to Callum Bruce, an analyst at Goldman Sachs Group Inc. In addition, a wave of record-breaking heat in Europe and parts of Asia is also making it harder to run lighter crudes, he added.

In China, the largest crude importer, a range of indicators point to buoyant demand. Congestion levels in the 15 cities with the most car registrations have risen by about a quarter compared with January 2021, according to data from Baidu Inc. tracked by BloombergNEF. At the same time, commercial gasoline inventories have been estimated at the lowest since at least 2019.

China’s gasoline demand is forecast at around 3.3 million barrels a day in July, according to estimates by Rystad Energy. That’s 14% higher than in the same month of 2019, the last year before Covid restrictions decimated consumption.

European Quandary

In Europe, gasoline usage has been rebounding too, with France, Germany, Spain and Italy all posting year-on-year increases in consumption. At the same time, the region is still feeling the supply pinch from sanctions on Russia that deprived local refiners of crude and other raw materials for gasoline.

The loss of heavy naphtha from Russia, for example, has led to a dearth of feedstock for gasoline-making units known as reformers. That has led to a squeeze in components that add to the octane rating of gasoline, ultimately squeezing the supply of gasoline that is suitable for European cars, according to Sparta Commodities.

Switching away from Russia’s flagship Urals grade to lighter American crude has led to an excess of light naphtha, which can be blended into gasoline but requires other components such as reformate. This dynamic has further lifted the cost of premium gasoline, which calls for more reformate.

The supply of gasoline has also been constrained by the recent counter-seasonal strengthening in diesel, according to Wood Mackenzie Ltd. That had prompted refiners to boost production of the fuel at the expense of gasoline, said Mark Williams, research director at the consulting firm.

--With assistance from Catarina Saraiva, Sarah Chen, Bill Lehane, Serene Cheong and Devika Krishna Kumar.

(Updates with gasoline demand estimates in 12th paragraph)

Author: Elizabeth Low, Chunzi Xu and Rachel Graham