Inflation, higher interest rates and declining real estate values are worsening wealth inequality in Canada, with younger households bearing the brunt of the financial pain.

The richest 20% of households controlled 67.8% of net worth in the country in the first quarter, while the bottom groups accounted for 2.7%, Statistics Canada reported Tuesday in Ottawa.

That difference of 65.1 percentage points was 1.1 points higher than the same period a year earlier. It’s the fastest increase in records dating back to 2010, although the wealth gap is still slightly narrower than in 2020.

The widening wealth gap is a challenge for Prime Minister Justin Trudeau, whose government has pledged to reduce inequality only to see it expand by a rapid rise in house prices during the pandemic. It also highlights a consequence of the Bank of Canada’s aggressive increases to interests rates to combat inflation, which are squeezing the country’s indebted households.

The least wealthy were affected more by recent economic pressures, seeing their net worth drop by 13.8%, more than triple the rate of decrease for the wealthiest.

The gap in the share of disposable income between households in the top and bottom 40% reached 44.7 percentage points, up 0.2 percentage points from a year ago.

The decline in net worth for all households was due almost entirely to real estate, with the average value falling by 8.6% from a year ago. The least wealthy group saw their mortgage debt rise at a much faster rate than the overall value of their property holdings.

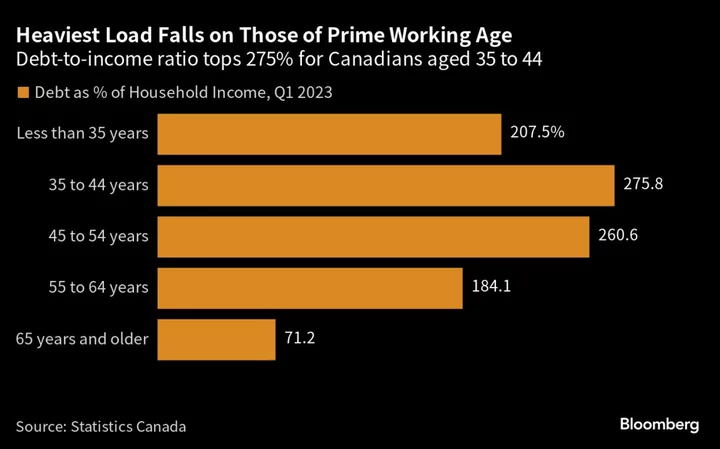

Debt-to-income ratios for younger and core working-age groups were also at record highs, and well above pre-pandemic rates. The ratio for the youngest households reached 207.5%, up 13.4 percentage points from a year ago. For those aged 35 to 44 years, the ratio jumped 16.6 percentage points to 275.8%.

Younger households have recently increased their share of Canada’s total population, accounting for 47.3% of all growth since the third quarter of 2021, due primarily to high levels of immigration.

“Persistently high interest rates and inflation are likely to continue to strain households’ ability to make ends meet without going further into debt, especially vulnerable groups, such as those with the lowest income, the least wealth and those of younger age groups,” the statistics agency said.

Author: Randy Thanthong-Knight