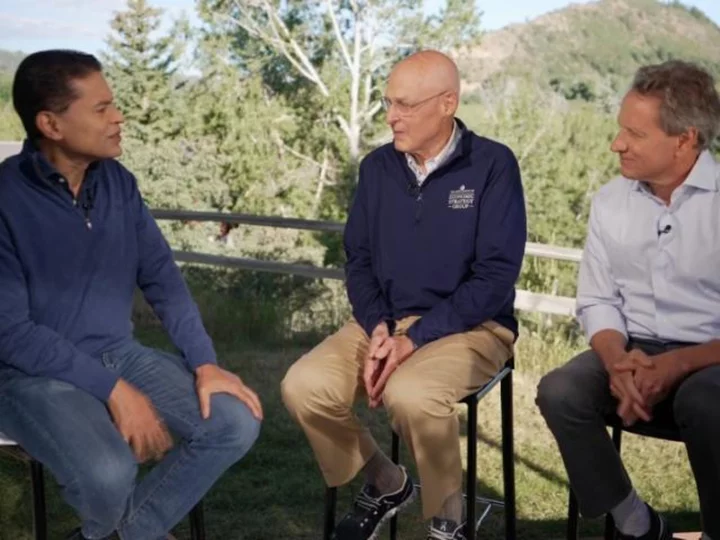

The US economy is resilient, but policymakers need to take the long view on the country's fiscal challenges, three former Treasury secretaries told CNN's Fareed Zakaria on Sunday.

Last week, Fitch Ratings, one of the world's top credit rating's agencies, downgraded the US government's credit rating from a stellar AAA to an AA+ due in part to "the erosion of governance ... over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions."

"It's too bad (the downgrade) came right after we had a bipartisan (agreement) to deal with the debt limit," said Henry Paulson, who headed the Treasury Department under George W. Bush. "But it's in some ways a very important wake-up call."

The downgrade came after a last-minute bipartisan deal in June that suspended the US debt ceiling until early 2025. But the deal was struck after months of deadlock on Capitol Hill that threatened to hurl the country into default, highlighting the unproductive brinkmanship that underlies debt negotiations in Congress.

Leading economists have largely denounced Fitch's downgrade by citing positive indicators. Inflation is at its lowest point in more than two years, and it appears increasingly likely the economy experiences a "soft landing," rather than slumps into a recession.

"Fitch's decision is puzzling in light of the economic strength we see in the United States. I strongly disagree with Fitch's decision, and I believe it is entirely unwarranted," Treasury Secretary Janet Yellen said Wednesday.

Long-term debt is a concern

Paulson said the debt is not an immediate worry.

"But, longer term, it's a major concern," said Paulson. "There's no example in history of any major power continuing to be a power where they lose their fiscal strength."

Timothy Geithner acknowledged the country continues to face long-term fiscal challenges.

"Ultimately, (the debt is) a judgment about the capacity of a country's political system," said Geithner, who served as Treasury Secretary during the Great Recession and when Standard & Poor's downgraded the nation's credit in 2011 from AAA to an AA+, the only other downgrading in US history.

"The world looks at our political system today and they wonder: 'Is America going to be able to find the will to come together and do this in a sensible way?'" he added. "I think that part of the problem is that it still feels remote and over the horizon. And, like any political system, the really hard challenge is trying to get people to focus on something that seems kind of far away."

Robert Rubin, who was the Treasury Secretary under Bill Clinton, told Zakaria that while the United States is "far and away best positioned in the global economy," the strength of the economy depends on the assumption "that, at some point or other, we will meet our policy challenges, not terrifically well, but at least reasonably well. And even though we have tremendous issues and problems in our political system, I think over time we will."

And then there's China

One policy challenge on the world stage is the US economic relationship with China, which Paulson and Geithner say veers into protectionism and nationalism. The world's two largest economies have had a strained relationship for years.

Beijing's updated counterespionage law, as well as its crackdown against Western consulting and due diligence firms, have unnerved US businesses. Meanwhile, the Biden administration is preparing new rules that could restrict investment in certain sectors in China, according to reports.

When asked about US-imposed tariffs on China, Paulson said "we are working to close markets at the same time that China is doing business with more and more of the world."

"China is a major, major competitor," he added. "If we sequester too much technology, what we're doing is essentially isolating US companies from the global economy ... I think we lose a lot if US companies aren't leading around the world."

-- CNN's Jennifer Hansler, Nectar Gan and Juliana Liu contributed to this reporting.