A South Korean battery maker tapped by the US to help it catch China in the clean-car market is losing money - a state of affairs expected to continue all year. Its chief financial officer isn’t concerned.

SK On Co., which along with Ford Motor Co. received a $9.2 billion loan from the US government to build three electric-car battery plants in America, is investing for the future, Chief Financial Officer Kyung-hun Kim said in his first interview since starting the job in October.

“We are now in a cycle that delays our profitability — we build a new plant, invest a lot of capital, suffer a loss until production is stabilized,” Kim told Bloomberg News. “Once we are about to see a small profit, we should build another plant, and we have a loss again.”

Read More: Ford Gets $9.2 Billion to Help US Catch Up With China’s EV Tech

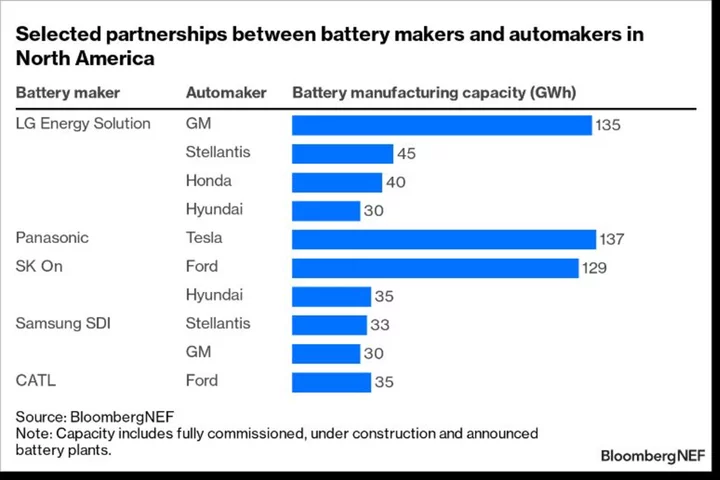

The churn is at least paying off with soaring sales, and helping the Seoul-based company cement its place in the burgeoning American EV market. It already has two plants in Georgia, and plans another in the state as part of a joint venture with Hyundai Motor Co. It plans to build three more with Ford — two in Kentucky and one in Tennessee — using funds from the Biden administration.

“Growth is so fast at our company — revenue will double this year to about 14 trillion won ($10.7 billion) from a year ago,” Kim said.

Biggest American Loan

The loan to BlueOval SK, a 50-50 joint venture between Ford and SK On, was the biggest from the US government to an automaker since the 2009 bailouts that saved General Motors Co. and what was Chrysler at the time from bankruptcy. It eased investor concerns about the feasibility of the massive production project for electric batteries, the most expensive part of an EV.

The money also paves the way to fulfill Ford’s pledge to make 2 million EVs by 2026. It took almost two years for Ford and SK On to get the loan, which was extended only after extensive due diligence conducted by the US on the South Korean company’s finances, technology and expected market impact.

The most appealing point for US authorities was the companies’ commitment to job creation, Kim said.

While the cash infusion eases concern about liquidity needed to build and run the new manufacturing facilities, the question on improving profitability remains, Kim said. The company had a 344.7 billion won loss in the first quarter, while local rivals LG Energy Solution Ltd. and Samsung SDI Co. posted strong profits on record revenues.

While SK On also posted record sales for the quarter, its operating margin has been at least 10% negative since 2021. Kim said he expects the company to hit full-year profitability in 2024.

Kim is in a unique position to help address the issue. A former investment banker with more than 25 years experience at companies including Standard Chartered Korea and Merrill Lynch, he’s eager to take on the challenge of boosting profitability amid rising demand from automakers for the batteries needed to power the industry’s future.

One element that may help is the estimated tax credits from Biden’s Inflation Reduction Act, which SK On could use to boost its results. Officials are discussing when the company will reflect those credits in its earnings, he said, as rival LG Energy did in the second quarter.

Even with the tax credits, the challenge remains of rebuilding manufacturing in a nation that’s pushed most types of production offshore to less expensive places. The situation is exacerbated by rising inflation, the fight for talent as unemployment rates plummet and a poorly prepared local workforce in many communities where the plants are being constructed.

Price Hikes

SK On may need to increase its prices given higher labor costs at manufacturing plants, especially those in the US, Kim said. A price rise might be necessary even with the IRA’s Advanced Manufacturing Production Credit.

“Labor costs are already high in US and we are not in a situation to sell batteries at low prices because of profitability,” he said.

Getting the plant up and running will also be a challenge. The pool of talented battery engineers is small and highly sought after by automakers, battery firms and companies in other industries. Educating the local workforce – beyond the battery engineers – will be necessary as the world’s biggest economy allowed its manufacturing sector to lay fallow for decades.

“It’s been such a long time for the US to be away from manufacturing,” Kim said. “It’s not easy to train and educate local workers living in a suburban area, where residents haven’t seen factories. It’ll be very difficult for the US to re-shore manufacturing.”

Driving Distance

A key question is how popular SK On’s batteries – and Ford’s EVs – will be. SK On’s competitive advantage is its high-nickel batteries, which maximize driving range, said Park Chulwan, a professor in the car engineering department at Seojeong University. But its dependence on just a few customers — especially Ford — is a risk, he said.

“What if Ford’s EVs are not as popular as they expected?” Park said. “That might lead to a rising inventory of batteries at SK’s plants.”

Read more: Ford’s EV Sales Sag Amid Slow Recovery From Factory Shutdown

SK On has a lot to prove to its investors and industry watchers after quarter upon quarter of losses, particularly given questions about the quality of its technology following a legal settlement with LG Energy in 2021. The company is dramatically ramping up production and experts say it can take four to five years to get steady results.

Time will eventually tell, and Kim says he’s willing to wait. The company is planning an initial public offering in the next four years, though it could come sooner depending on the market and the battery-maker’s profitability, he said. What he doesn’t want is to compromise on quality.

“We are moving at a slower pace than your expectation, but we are moving forward anyway,” Kim said. “We are trying to be lean on costs, but that shouldn’t sacrifice the quality of products.”