By Dan Burns

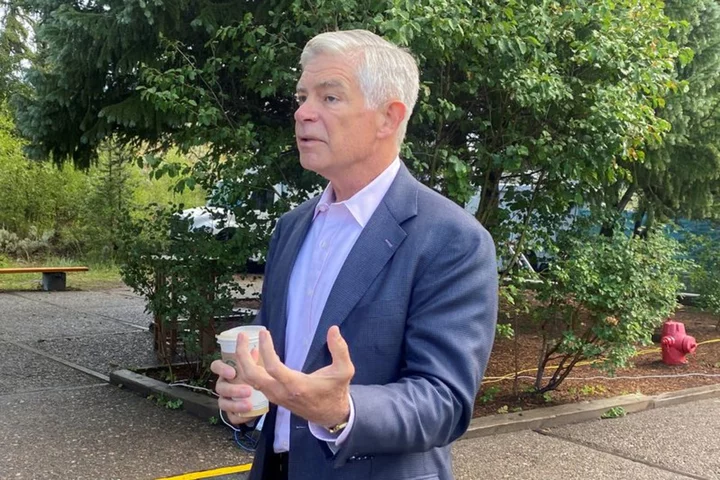

Barring any abrupt change in the direction of recent economic data, the U.S. Federal Reserve may be at the stage where it can leave interest rates where they are, Philadelphia Fed President Patrick Harker said on Tuesday.

“Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work,” Harker said in remarks prepared for delivery at an event in Philadelphia.

The remarks from Harker, who has a vote this year on the rate-setting Federal Open Market Committee and supported last month's rate increase, are perhaps the strongest yet from a Fed official on whether to raise interest rates at the central bank's Sept. 19-20 meeting.

Should it be appropriate to cease raising rates, however, Harker said "we will need to be there for a while. The pandemic taught us to never say never, but I do not foresee any likely circumstance for an immediate easing of the policy rate."

Like other Fed officials, Harker welcomed recent data showing inflation has eased substantially from four-decade highs a year ago at this time, and he expects that to continue. Harker said he now expects the Personal Consumption Expenditures price index, stripped of food and energy costs, to drop to just below 4% by year end and to below 3% in 2024 before "leveling out at our 2% target in 2025."

The Fed raised its benchmark policy rate by a quarter percentage point at its meeting last month to a range of 5.25% to 5.50%. Projections from policymakers at their June meeting signaled that a majority then expected another increase beyond that, but the recent easing in inflation has kindled a more fulsome debate over the matter.

Harker said he does expect a modest uptick in the unemployment rate, last at 3.5% in July, and a slowing in gross domestic product growth from its recent pace.

"In sum, I expect only a modest slowdown in economic activity to go along with a slow but sure disinflation," Harker said. "In other words, I do see us on the flight path to the soft landing we all hope for and that has proved quite elusive in the past."

(Reporting By Dan Burns; Editing by Andrew Heavens)